Life insurance contracts must meet irs requirements. This tax free exclusion also.

Are Life Insurance Premiums Tax Deductible Quotacy

Are Life Insurance Premiums Tax Deductible Quotacy

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them.

Is life insurance taxable income. If you have employer provided life insurance known as group life insurance any coverage over 50000 is treated as taxable income but any amount under 50000 is not taxed. The irs spells it out. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them life insurance. Life insurance is almost always not taxable. See topic 403 for more information about interest.

For federal income tax purposes an insurance contract cannot be considered a life insurance contract and qualify for favorable tax treatment unless it meets state law requirements and satisfies the irss statutory definitions of what is or is not a life insurance policy. However any interest you receive is taxable and you should report it as interest received. A life insurance payout isnt considered gross income.

Group life insurance can be a nice addition to your benefits package especially if its free or nearly free. Therefore its not taxable. Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout.

Tax Saving How Life Insurance Can Help You Save Tax Under Section

Tax Saving How Life Insurance Can Help You Save Tax Under Section

Is Life Insurance Taxable 2019 2020 Mintco Financial

Is Life Insurance Taxable 2019 2020 Mintco Financial

Solved All Of The Following Are Types Of Taxable Income E

Solved All Of The Following Are Types Of Taxable Income E

Life Insurance Through Super A Definitive Guide

Life Insurance Through Super A Definitive Guide

Supplemental Retirement Planning Lincoln Financial

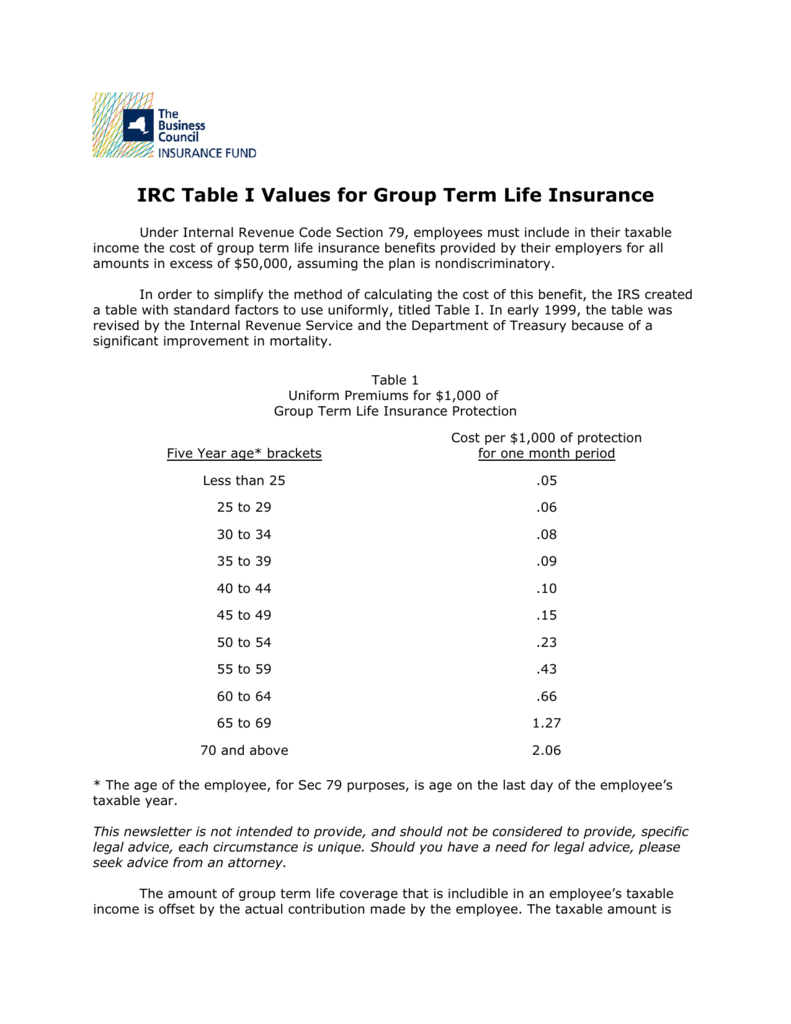

To Have Access To Irc Table I Values For Group Term Life Insurance

To Have Access To Irc Table I Values For Group Term Life Insurance

Licit Life Insurance Company Taxable Income In Business

Licit Life Insurance Company Taxable Income In Business

The Table Reflects Common Income Items It Separates Income Items

The Table Reflects Common Income Items It Separates Income Items

Http Www Kenyalaw Org Tribunals Taxappealtribunal Madison Insurance Limited V Commissioner Of Domestic Taxes 5b2017 5d Eklr Pdf

Tax Saving Investments Up To Rs 62 400 May Be Saved By Investing

Tax Saving Investments Up To Rs 62 400 May Be Saved By Investing

Life Insurance Income Taxation In Brief Pdf Free Download

Life Insurance Income Taxation In Brief Pdf Free Download

Page United States Statutes At Large Volume 98 Part 1 Djvu 768

Page United States Statutes At Large Volume 98 Part 1 Djvu 768

Life Insurance Policies Life Insurance Policies Taxable Income

Life Insurance Policies Life Insurance Policies Taxable Income

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

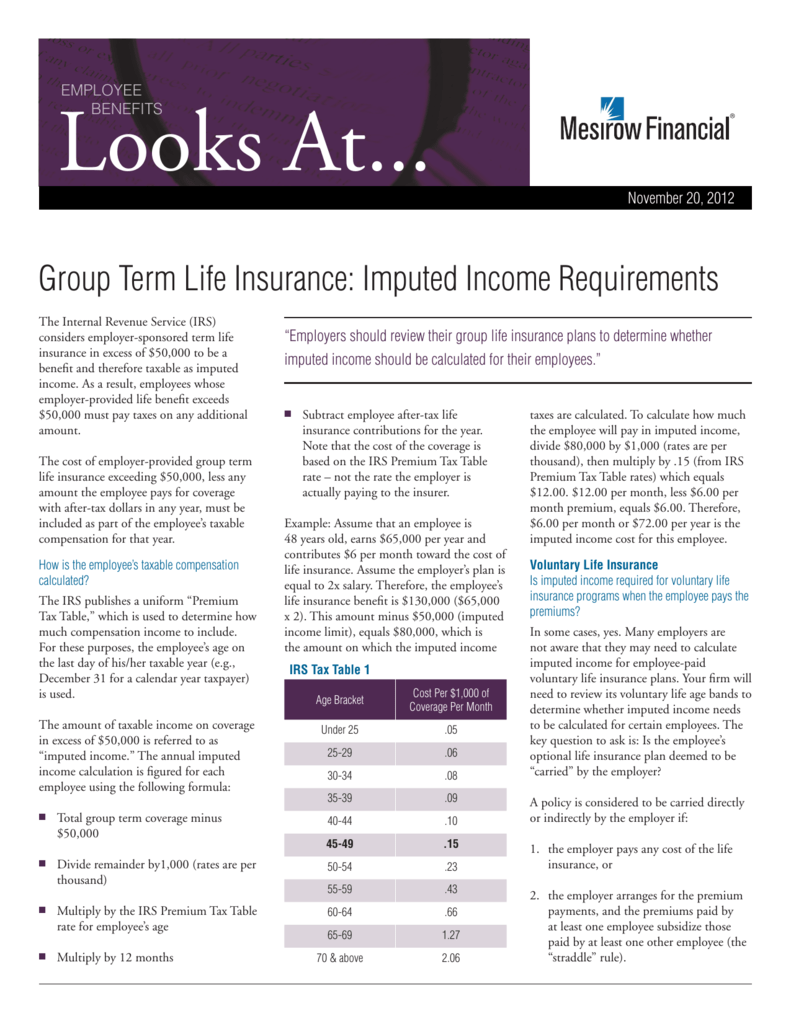

Group Term Life Insurance Imputed Income

Group Term Life Insurance Imputed Income

The Often Overlooked Income Tax Rules Of Life Insurance Policies

The Often Overlooked Income Tax Rules Of Life Insurance Policies

Understanding Taxes On Life Insurance Premiums

Understanding Taxes On Life Insurance Premiums

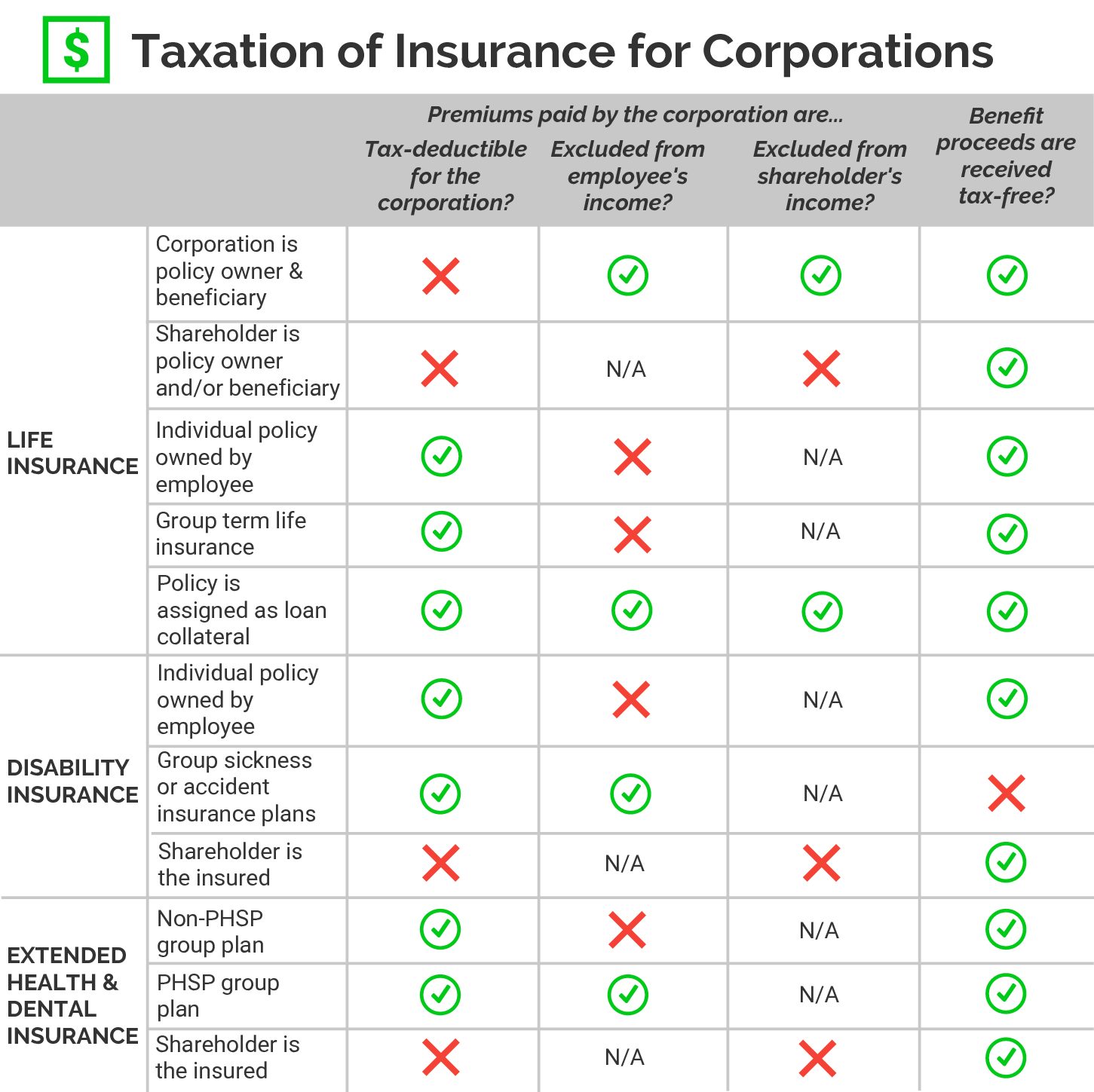

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Company Provided Life Insurance Finance Zacks

Taxation Of Company Provided Life Insurance Finance Zacks

Federal Income Taxation Of Life Insurance Companies Lexisnexis Store

Federal Income Taxation Of Life Insurance Companies Lexisnexis Store

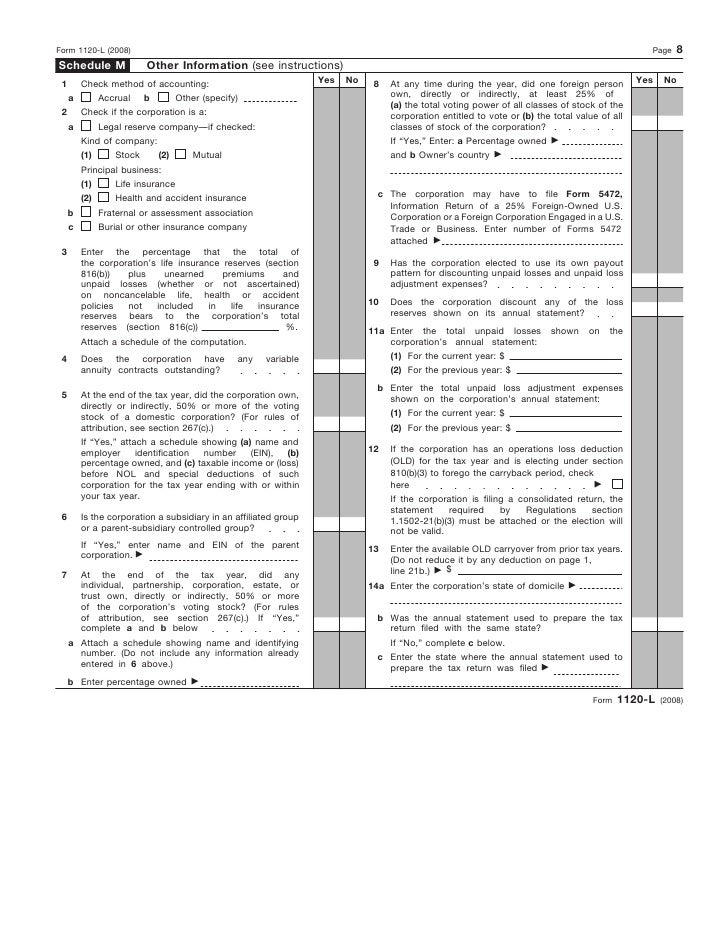

Form 1120 L U S Life Insurance Company Income Tax Return

Form 1120 L U S Life Insurance Company Income Tax Return

Whether Your Life Insurance Policy Is Eligible For Tax Saving

Whether Your Life Insurance Policy Is Eligible For Tax Saving

0 Komentar untuk "Is Life Insurance Taxable Income"