How to sell life insurance without cold calling. Avoid responding to life settlement.

Sell Your Settlement 3 Tips For Selling Your Life Settlement

Sell Your Settlement 3 Tips For Selling Your Life Settlement

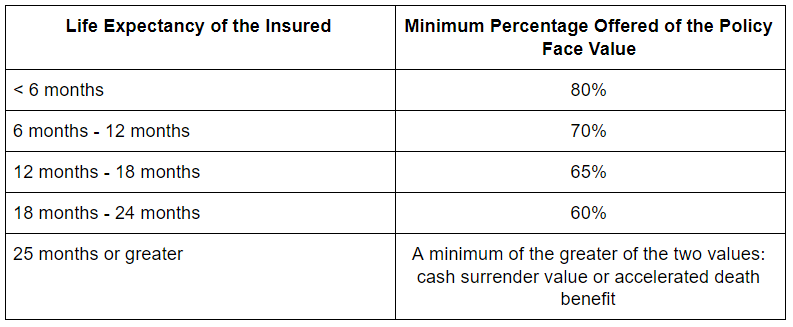

Whether you should sell your life insurance policy is dependent on several factors mainly whether itll affect your tax obligations and how much your family expects you to leave for them.

How to sell your life insurance. Persuading consumers of the need to buy. Follow these steps to make sure you get the best deal if you really want to sell your life insurance policy. How life settlements work.

Talk to your beneficiaries and to experts on tax law and insurance before making a decision. What does it mean to sell a life insurance policy. Selling insurance has grown into a multi billion dollar industry and knowing how to sell insurance can be a lucrative career.

Before you decide to sell a life insurance policy for cash carefully examine all of your options be aware of the pitfalls and make sure that it is a good decision for your specific circumstances. Life insurance sales could well be for you. Most people purchase life insurance when they are looking for ways to protect their familys financial stability in the event of death.

Although cold calling is a classic sales method its extremely time consuming often with few worthwhile results. Selling a life insurance policy involves selling the policy to another entity or investor. There may come a time when you wonder if it makes sense to continue to pay your life insurance premiums or if you want to cash in your life insurance policy.

As the policy owner you typically receive more money than you would get if you cancelled or surrendered the policy but less than the policys death benefit. Investing in life insurance leads allows you to skip the first step in the sales process. Life settlements involve selling a policy to a company other than the original insurance provider.

Selling your life insurance policy safely. Table of contents. You just have to have the right marketing strategies down to grow your business and become an effective sales person.

Want to sell life insurance. Insurance laws are administered at the state level which means that each state has its own set of policies and requirements surrounding insurance licensing. Updated jan 29 2020.

As mentioned above to sell insurance you will need to carry an insurance license. Read this first. Facebook twitter linkedin by greg mcfarlane.

Trading your life insurance for cash might seem creepy but these tips help you profit.

Life Insurance Cross Sell Brochure Mines Press

Life Insurance Cross Sell Brochure Mines Press

How To Sell Your Life Insurance Policy Get More Cash Insurance

How To Sell Your Life Insurance Policy Get More Cash Insurance

Life Settlements House And Home Adventures Of Frugal Mom

Life Settlements House And Home Adventures Of Frugal Mom

Selling Your Life Insurance Policy Business Hours

Selling Your Life Insurance Policy Business Hours

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

Can I Sell My Life Insurance Policy Selling Your Insurance Policy

Can I Sell My Life Insurance Policy Selling Your Insurance Policy

Sell Your Life Insurance Policy Don T Just Give It Up Thestreet

Sell Your Life Insurance Policy Don T Just Give It Up Thestreet

Should You Sell Your Life Insurance Policy Youtube

Should You Sell Your Life Insurance Policy Youtube

Can I Sell My Life Insurance And If I Can Should I

Can I Sell My Life Insurance And If I Can Should I

Does It Make Sense To Sell Your Life Insurance Policy Aol Finance

Does It Make Sense To Sell Your Life Insurance Policy Aol Finance

Investment Wise Does It Make Sense To Sell Your Life Insurance

Investment Wise Does It Make Sense To Sell Your Life Insurance

15 Odd Ways To Make Money For Life Insurance Premiuims

15 Odd Ways To Make Money For Life Insurance Premiuims

Selling Your Life Insurance Policy Why And How Houston Chronicle

Selling Your Life Insurance Policy Why And How Houston Chronicle

Why Sell Your Life Insurance Policy

Why Sell Your Life Insurance Policy

Is It Possible To Sell Your Life Insurance Policy For Cash

Is It Possible To Sell Your Life Insurance Policy For Cash

Sell Your Life Insurance Before You Die Whatnext

Sell Your Life Insurance Before You Die Whatnext

Selling Your Life Insurance Policy Can Give You Cash

Selling Your Life Insurance Policy Can Give You Cash

.jpg) Fegli Life Settlements Viatical Settlements For Federal

Fegli Life Settlements Viatical Settlements For Federal

Sell Your Life Insurance Policy Why Would You Viatical

Sell Your Life Insurance Policy Why Would You Viatical

/shutterstock_241803703-5bfc3d8b4cedfd0026c592da.jpg) How Can I Borrow Money From My Life Insurance Policy

How Can I Borrow Money From My Life Insurance Policy

My Publications The Best Way To Buy Sell Or Replace Life

My Publications The Best Way To Buy Sell Or Replace Life

0 Komentar untuk "How To Sell Your Life Insurance"