However it wouldnt be fair for the insurance companies not to allow people to change plans when they have a major life event that changes their needs. But whether happy or not many of the big moments count as qualifying life events when it comes to health insurance enrollment.

An Evening Of Regional Performers And Storytellers Delmarvalife

An Evening Of Regional Performers And Storytellers Delmarvalife

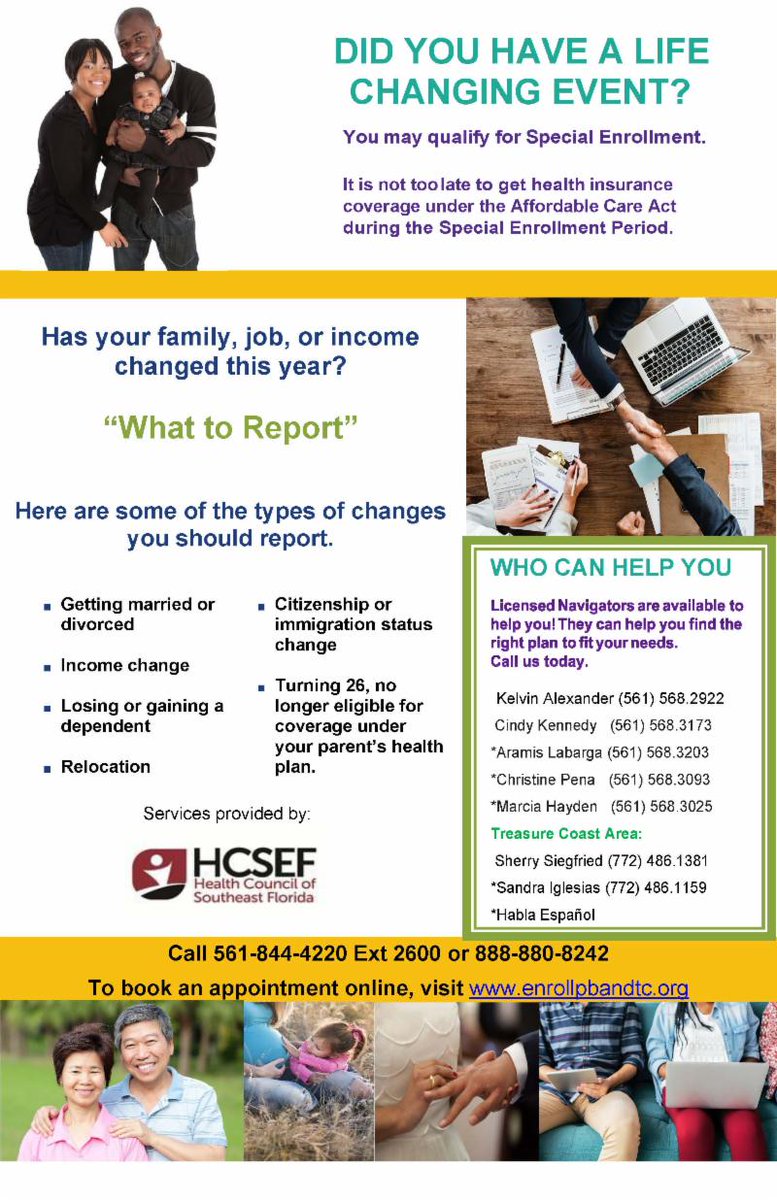

Whether its marriage retirement loss of a loved one or birth of a new baby there are many family related life events that may qualify.

Insurance life changing event. This is due to insurance policies being specific to certain areas and only allow doctors and facilities in that area. Some of those changes are planned some arent. Insurance companies agree to lock in rates for the year in exchange for keeping people from switching plans at will.

Life changing events can impact your federal insurance and employment benefits and may include the birth or adoption of a child marriage or divorce the death or illness of a loved one or a change in employment. Life cycle events is a listing of common events that may occur during or after your federal career. Whenever your household changes think about how that change will affect your health insurance.

Common qualifying events include losing eligibility for health insurance coverage because you quit working or changed employers or because your employer reduced your hours or changed your employment status. The concept of a qualifying life event is that it is a life changing circumstance that impacts your situation in particular to health insurance. For these reasons the death of someone you share a health insurance plan with can count as a qualifying life event.

Change in residence moving to a new location for work school or just because you need a change of scenery can often make an insurance policy useless. This page explains action that are available to you as a result of a life event. Short term health insurance is another option to explore if youre between enrollment periods.

Its likely that major events in your householdlike gaining or losing a memberwill result in a special enrollment. Any of these events count as an irs qualifying life event. Although some of the qualifying life events seem straightforward there are important factors about these qualifying life events that make them qualify you for special enrollment.

Types of qualifying life events family. Families are always changing at every stage of life. Qualifying life event qle a change in your situation like getting married having a baby or losing health coverage that can make you eligible for a special enrollment period allowing you to enroll in health insurance outside the yearly open enrollment period.

A qualifying job related change of life event can be one that either causes you to gain or lose eligibility.

Insure Your Home And Ease Your Mind With These Tips

Insure Your Home And Ease Your Mind With These Tips

![]() Personal Narrative Essay Life Changing Event Insurance

Personal Narrative Essay Life Changing Event Insurance

3 Life Changing Events That May Change Your Insurance Needs

3 Life Changing Events That May Change Your Insurance Needs

Covered California On Twitter Had A Life Changing Event In The

Covered California On Twitter Had A Life Changing Event In The

Life Insurance Through Employer Cigna

Life Insurance Through Employer Cigna

When Can I Buy Insurance Connect For Health Colorado

When Can I Buy Insurance Connect For Health Colorado

Specialenrollment Hashtag On Twitter

Specialenrollment Hashtag On Twitter

Critical Illness Coverage Helping With Treatment Costs Of Life

Critical Illness Coverage Helping With Treatment Costs Of Life

Options Now Limited For 2016 Health Insurance

Options Now Limited For 2016 Health Insurance

Major Life Events And Their Impact On Life Insurance

Major Life Events And Their Impact On Life Insurance

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

![]() Qualifying Life Events And Special Enrollment Periods For Aca

Qualifying Life Events And Special Enrollment Periods For Aca

Get Coverage In Special Enrollment Covered California

4 Life Changing Events That Affect Your Life Insurance

4 Life Changing Events That Affect Your Life Insurance

Obamacare Outside Oep Enrollment

Obamacare Outside Oep Enrollment

3 Life Changing Events That May Change Your Insurance Needs

3 Life Changing Events That May Change Your Insurance Needs

Frequently Asked Questions Faqs Pdf Free Download

Frequently Asked Questions Faqs Pdf Free Download

Changing Health Insurance At Age 26 Unitedhealthone

Changing Health Insurance At Age 26 Unitedhealthone

Still Need Health Insurance Coverage For 2017

Still Need Health Insurance Coverage For 2017

Seven Life Changing Events That Can Affect Your Auto Insurance

Seven Life Changing Events That Can Affect Your Auto Insurance

0 Komentar untuk "Insurance Life Changing Event"