Tax on life insurance premiums. Life insurance premiums are not tax deductible.

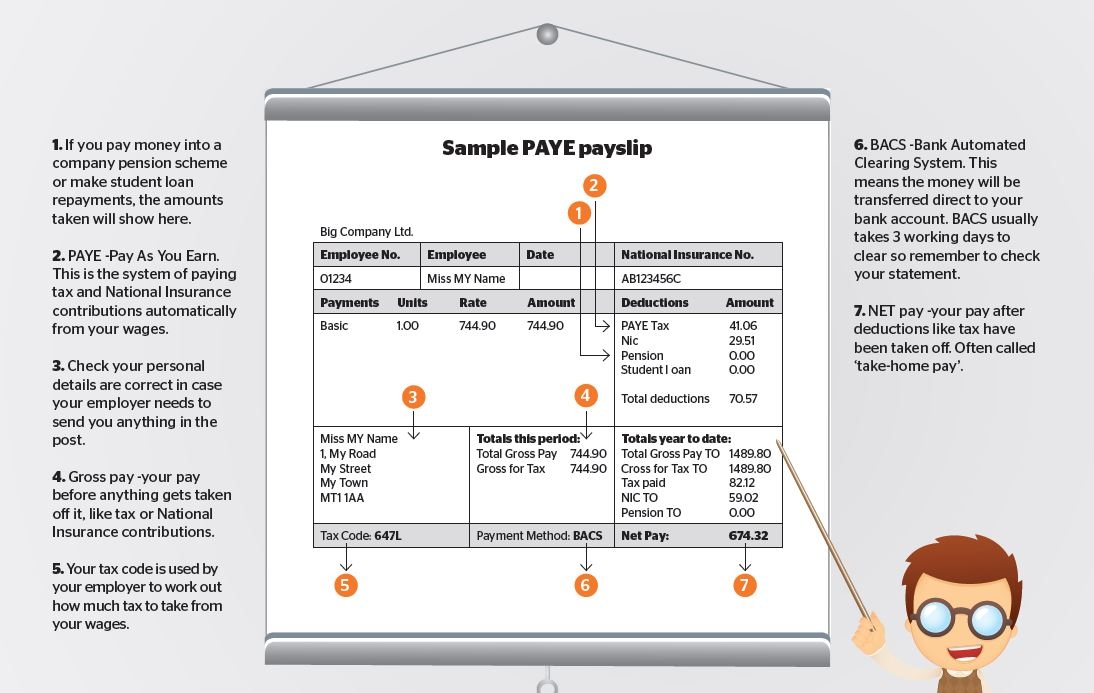

Your Bullsh T Free Guide To Income Tax In The Uk

Your Bullsh T Free Guide To Income Tax In The Uk

In simple terms if you had a life insurance policy and you died then your beneficiaries would receive a lump sum pay out.

Is life insurance tax deductible in australia. Is life insurance tax deductible in super. If you want to take advantage of tax benefits when paying insurance premiums you need to understand the types of life insurance that are tax deductible. Premiums are usually deductible to your super fund when premiums are paid from your pre taxed income.

Firstly lets address what we define life insurance to be so that we are on the same page in regards to its tax deductible status. Whether your life insurance premium is tax deductible or not will depend on what kind of insurance it is and how you purchased it. Is the cost you pay for life insurance that you own and pay for able to be claimed as a tax deduction.

On that note we should also cover off on what we are proposing to claim a tax deduction on. Life trauma total and permanent disability tpd and income protection. Where the life insurance policy in question commences after 7 december 1983 amounts received by way of bonuses under that policy are assessable in full in the first 8 years after the policy commences and in years 9 and 10 of the policy two thirds and one third respectively of the bonus is assessable.

Your super fund can claim the refund on your premiums and then pass it on to you. Tax treatment of life insurance premiums. If the policy provides benefits of an income and capital nature only that part of the premium attributable to the income benefit is deductible.

The term life insurance refers to four types of cover. Income protection insurance mirrors life insurance in that its tax deductible under superannuation. Each cover has a different purpose.

Trauma insurance is not currently available through superannuation therefore the premiums for this are not tax deductible. To find the best life insurance in australia you should try lisa group life insurance comparison they compare top 10 insurance companies in australia and offer 30 off or try this. You must include any payment you receive under such a policy on your tax return.

If you pay your life insurance premiums with your superannuation monies then your premiums are usually tax deductible to your fund. Your life insurance benefit will only be paid tax free when it is left to a financial dependant such as your spouse or children under the age of 18. Life insurance is an umbrella term.

Tpd insurance is only tax deductible when provided under superannuation. You can claim the cost of premiums you pay for insurance against the loss of your income. Is life insurance tax deductible.

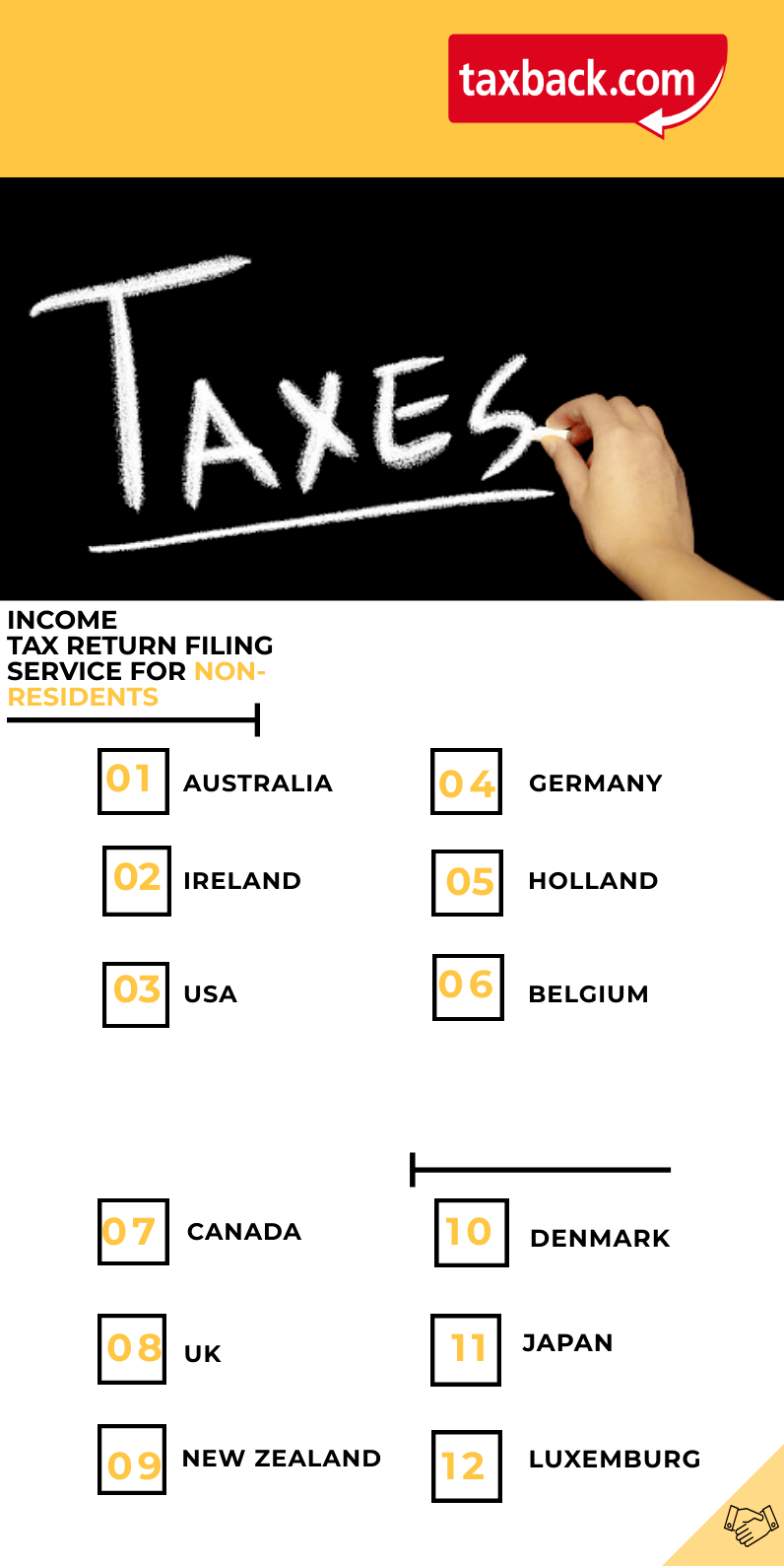

Top 7 Australia Tax Questions From Expats Sydney Moving Guide

Top 7 Australia Tax Questions From Expats Sydney Moving Guide

![]() Forms Superannuation Fact Sheets Australiansuper

Forms Superannuation Fact Sheets Australiansuper

Taxes Pensions And Health Insurance Gaijinpot

Taxes Pensions And Health Insurance Gaijinpot

Crafting A Better Consumption Tax The Accj Journal

Crafting A Better Consumption Tax The Accj Journal

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png) Payroll Taxes And Employer Responsibilities

Payroll Taxes And Employer Responsibilities

Life Insurance Quotes Save 20 On Premiums With Nobleoak

Getting Health Insurance In Switzerland A Complete Guide

Getting Health Insurance In Switzerland A Complete Guide

Declaring Foreign Income In Canada

Declaring Foreign Income In Canada

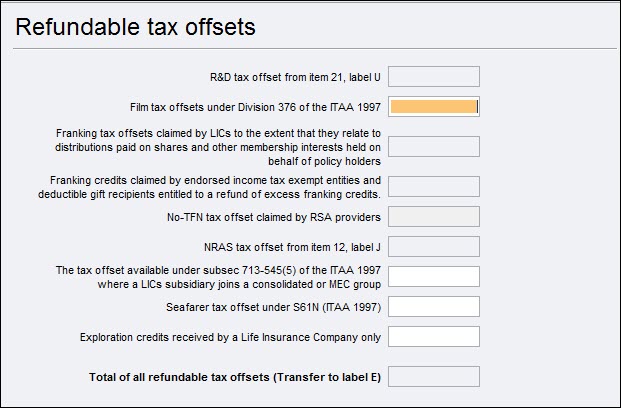

Refundable Tax Offsets Worksheet Rto Ps Help Tax Australia

Refundable Tax Offsets Worksheet Rto Ps Help Tax Australia

Adviser Logo Your Best Back Up Tool Is Insurance Insurance For

Adviser Logo Your Best Back Up Tool Is Insurance Insurance For

Prime Cost Straight Line And Diminishing Value Methods

Prime Cost Straight Line And Diminishing Value Methods

Lodgeit Depreciation Low Value Pool Lvp On R

Instant Cover Product Disclosure Statement Pds A Flexible Life

Instant Cover Product Disclosure Statement Pds A Flexible Life

Corporate Life Insurance Opportunities To Die For

Corporate Life Insurance Opportunities To Die For

October 31 Is The Tax Return Deadline These Are The Rules On

October 31 Is The Tax Return Deadline These Are The Rules On

Solved Question 1 On 21 November The Weekly Payroll Regi

Solved Question 1 On 21 November The Weekly Payroll Regi

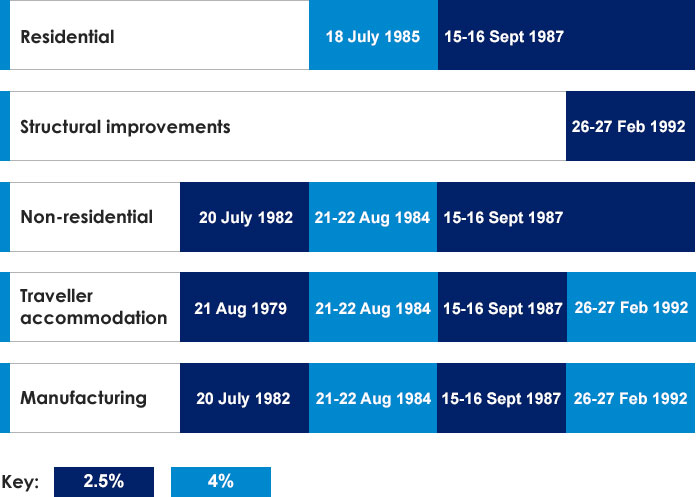

Tax Depreciation Bmt Tax Depreciation

Tax Depreciation Bmt Tax Depreciation

How To Claim Tax Deductible Donations On Your Tax Return

How To Claim Tax Deductible Donations On Your Tax Return

Corporate Life Insurance Opportunities To Die For

Corporate Life Insurance Opportunities To Die For

Private Health Insurance And Tax Iselect

Private Health Insurance And Tax Iselect

Deduction Spreadsheet Template Free Tax Excel Sales Templates

Deduction Spreadsheet Template Free Tax Excel Sales Templates

0 Komentar untuk "Is Life Insurance Tax Deductible In Australia"