Whether youre an individual or a business owner its essential that you consult a licensed accountant for any tax related questions as they can offer the most accurate advice based on your situation. It is a common misconception that running a business entitles owners to deductible life insurance premiums.

Health Insurance Tax Benefits Under Section 80d

Health Insurance Tax Benefits Under Section 80d

The s corporation must also sometimes report life insurance premiums as taxable wages paid to the employee.

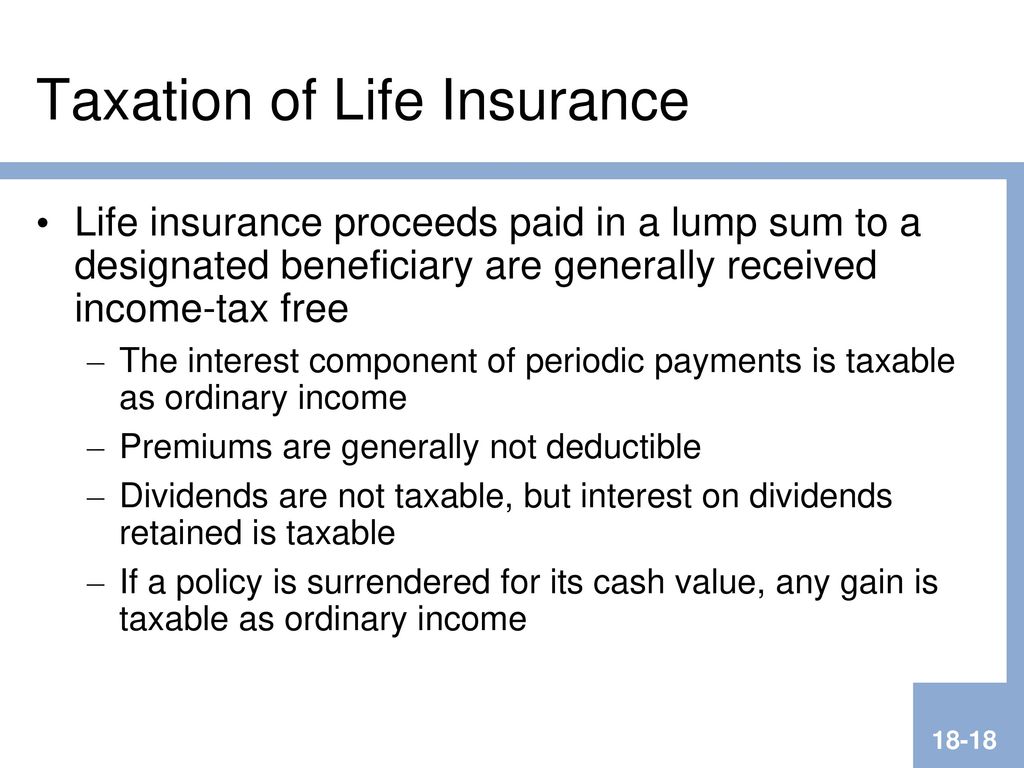

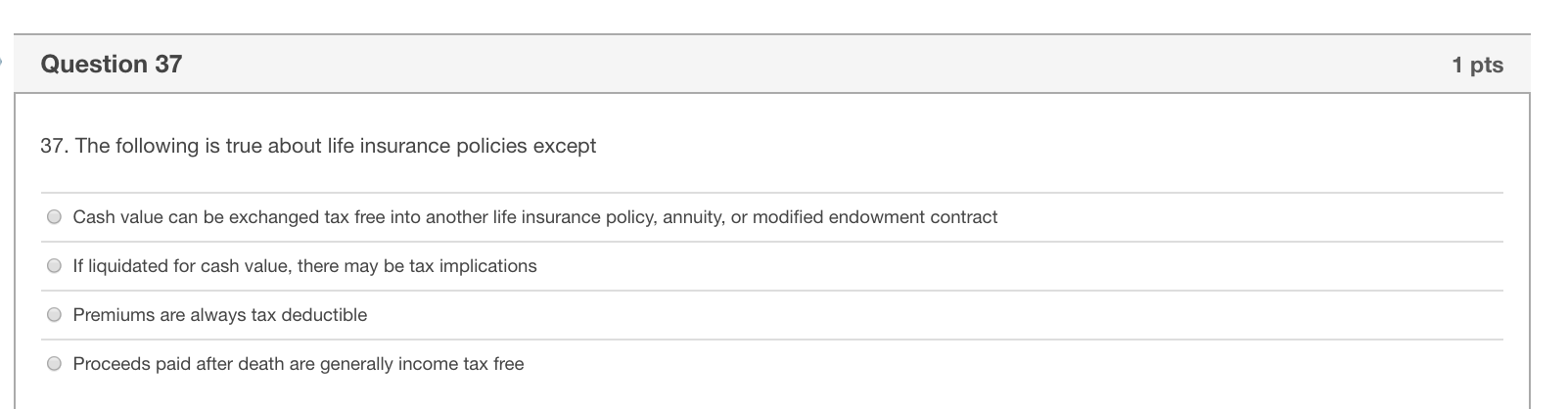

Is life insurance premiums tax deductible. The only exceptions are when you pay premiums for someone elses policy. Life insurance policy premiums do not typically qualify as eligible income tax deductions. As an individual when you pay life insurance premiums they are not deductible on your income tax return.

Deductible employer paid life insurance premiums. However in certain situations involving employee benefits and other corporate arrangements some of the. This is a legitimate request from a business owner who is used to deducting expenses that occur during the usual course of operations.

If the s corporation itself is not the beneficiary the premiums are deductible. If the s corporation is the beneficiary the premiums are not deductible. However if the business is the beneficiary such as in corporate owned life insurance coli or bank owned life insurance boli the tax consequences may be different.

But thats not always true. Unfortunately your life insurance premiums are not tax deductible with rare exceptions. The tax law is fair in the sense that it will usually not ask your designated beneficiary to pay taxes on your life insurance payouts when you pass away.

Unlike the strict rules for individuals its true that businesses have a bit more leniency with tax deductible life insurance premiumsbut only in very specific cases are they deductible as a business expense. Life insurance premiums are tax deductible for an s corporation sometimes. Basically you can never deduct life insurance premiums from your taxes if you bought a policy for yourself meaning it pays out upon your death.

The question frequently arises as to whether or not life insurance premiums are tax deductible if they are paid for by a business. You are included among potential beneficiaries. However if you are a business owner and you pay life insurance premiums on behalf your employees your expenses may be deductible.

The good news is that just as insurance premiums are not tax deductible for the individual insurance holder the payouts of life insurance are also usually not taxable. You cant deduct premiums on some life insurance and annuities. For the most part life insurance premiums are not tax deductible but there are certain situations where they can be.

If a business purchases the life insurance and is not the beneficiary of the policy payout the premiums are tax deductible as a business expense. For policies issued before june 9 1997 you cant deduct the premiums on a life insurance policy covering you an employee or any person with a financial interest in your business if you are directly or indirectly named as a beneficiary of the policy. Heres a look at what the canada revenue agency requires.

Is Life Insurance Tax Deductible In Australia Iselect

Is Life Insurance Tax Deductible In Australia Iselect

Chapter 13 18 Life Insurance Purchase Decisions Ppt Download

Chapter 13 18 Life Insurance Purchase Decisions Ppt Download

Are Life Insurance Premiums Tax Deductible True Blue Life Insurance

Are Life Insurance Premiums Tax Deductible True Blue Life Insurance

Life Insurance Premium Deduction Under Section 80c

Life Insurance Premium Deduction Under Section 80c

Life Insurance Archives Page 2 Of 15 Insurance Specialists

Life Insurance Archives Page 2 Of 15 Insurance Specialists

Health Insurance Tax Deductions Save Money Do You Qualify

Health Insurance Tax Deductions Save Money Do You Qualify

Get Income Tax Deduction On Life Insurance Premium Paid For Adult

Get Income Tax Deduction On Life Insurance Premium Paid For Adult

Whether Your Life Insurance Policy Is Eligible For Tax Saving

Whether Your Life Insurance Policy Is Eligible For Tax Saving

Is There Life Insurance Interest On Life Insurance Loan Tax

Is There Life Insurance Interest On Life Insurance Loan Tax

Income Tax Benefits Of Paying Insurance Premium In India

Income Tax Benefits Of Paying Insurance Premium In India

Is Life Insurance Tax Deductible In Australia Iselect

Is Life Insurance Tax Deductible In Australia Iselect

Philippines General Insurance Continued Pdf Free Download

Philippines General Insurance Continued Pdf Free Download

Saving Tax Through Deductions Smart Money News Issue Date Jan

Saving Tax Through Deductions Smart Money News Issue Date Jan

Deduct Life Insurance Premiums Or Not Incite Tax

Deduct Life Insurance Premiums Or Not Incite Tax

Solved Question 39 1 Pts 39 All Of The Following Might B

Solved Question 39 1 Pts 39 All Of The Following Might B

Search Q 80d Medical Insurance Premium Receipt Tbm Isch

Income Tax Deduction And Exemption To Insurance Policy Planmoneytax

Income Tax Deduction And Exemption To Insurance Policy Planmoneytax

You May Lose Tax Benefit On Your Life Insurance Policy If It Lapses

You May Lose Tax Benefit On Your Life Insurance Policy If It Lapses

Can I Get A Tax Deduction For My Life Insurance Premium And If So

Can I Get A Tax Deduction For My Life Insurance Premium And If So

Section 80c Tax Deduction Under Section 80c In India Kotak Life

Section 80c Tax Deduction Under Section 80c In India Kotak Life

How Your Lic Premiums Can Help You Save Income Tax

How Your Lic Premiums Can Help You Save Income Tax

0 Komentar untuk "Is Life Insurance Premiums Tax Deductible"