Universal life insurance is permanent life insurance with an investment savings element and low premiums like term life insurance. It is simply a life insurance policy that will provide your beneficiary with a death benefit from accidental or natural death for a specified amount of time.

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

A term life insurance policy is the easiest and most basic type of life insurance.

Is universal life insurance whole or term. Much like universal life insurance whole life has the potential to accumulate cash value over time. Beyond that the other major benefit wholeuniversal life insurance offers is that the premiums have the capability of growing as cash value over the life of the policy. A common strategy thats promoted is to buy term and invest the difference.

Universal life insurance gives consumers flexibility in the premium. Isnt the investment portion of whole and universal life insurance a great benefit. Term life insurance coverage ends after a certain amount of time while universal life is with you as long as you pay your premiums.

With this extended period premiums are considerably more expensive. The rates are typically much closer to the higher whole life rates than the term rates in fact universal life insurance rates are sometimes even higher than whole life insurance rates. Whole life insurance caters to long term goals offering consumers consistent premiums and guaranteed cash value accumulation.

What is whole life insurance. It can be but you pay a lot for it. Now if youre dead set pun intended on having your family receive a financial benefit when you pass away you might want to consider universal life insurance.

Because of this feature premiums may be higher than term insurance. Most universal life insurance policies contain a flexible premium. Universal life is a form of permanent life insurance with a cash.

The pros and cons of universal life insurance. Whole and universal life insurance differ from term insurance in that they last for your whole life. Youre sure to encounter different and confusing policies and phrases such as whole life term life cash value and variable life.

Compare these two life insurance options thinking about needs cost and how long you need coverage. But you should know when it comes to insurance universal life insurance is much more expensive. Term life insurance provides coverage for a specific period of time for a fixed premium and with no cash value accumulation.

Life insurance provides important financial benefits but navigating the landscape of its terms and implications can be tricky. Whole life insurance policies have a fixed premium meaning you pay the same amount each and every year for your coverage.

Types Of Life Insurance Policies Explained

Types Of Life Insurance Policies Explained

Why Whole Life Insurance Is A Bad Investment

Why Whole Life Insurance Is A Bad Investment

Don T Be Confused Here S The Gist Of Term Vs Whole Life

Don T Be Confused Here S The Gist Of Term Vs Whole Life

Types Of Life Insurance Universal Life Insurance Term Life

Types Of Life Insurance Universal Life Insurance Term Life

Term Vs Whole Life Insurance Golfs Hub

Term Vs Whole Life Insurance Golfs Hub

Search Q Term Vs Whole Life Tbm Isch

Types Of Life Insurance Explained Youtube

Types Of Life Insurance Explained Youtube

Buying Universal Life Insurance Read This First

Buying Universal Life Insurance Read This First

Term Insurance Whole Life Universal Life Index Universal Life

Term Insurance Whole Life Universal Life Index Universal Life

Indexed Universal Life Iul Insurance Policies All You Need To

Indexed Universal Life Iul Insurance Policies All You Need To

Whole Term And Universal What Are The Different Life Insurance

Whole Term And Universal What Are The Different Life Insurance

What Is Universal Life Insurance And Is It A Good Investment

What Is Universal Life Insurance And Is It A Good Investment

Solved Understanding Universal Life Insurance Universal L

Solved Understanding Universal Life Insurance Universal L

Whole Life Insurance Term Life Insurance Universal Life Insurance

Whole Life Insurance Term Life Insurance Universal Life Insurance

Collectivism How It Affects Your Ability To Create Wealth Life

Collectivism How It Affects Your Ability To Create Wealth Life

Whole Life Insurance How It Works

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Should You Get Indexed Universal Life Iul Insurance Smartasset

Should You Get Indexed Universal Life Iul Insurance Smartasset

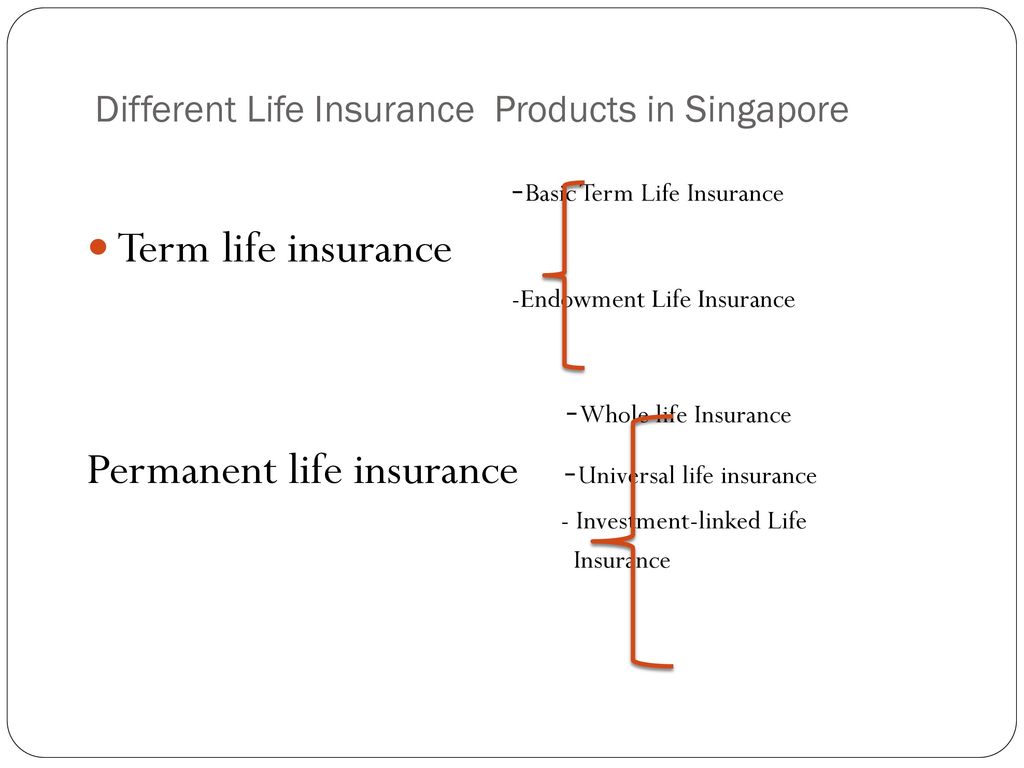

Life Insurance Types In Singapore Ppt Download

Life Insurance Types In Singapore Ppt Download

Term Life Insurance Vs Whole And Universal Life Insurance Policies

Term Life Insurance Vs Whole And Universal Life Insurance Policies

5 Life Insurance Types To Know The Motley Fool

5 Life Insurance Types To Know The Motley Fool

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

0 Komentar untuk "Is Universal Life Insurance Whole Or Term"