Life insurance proceeds are typically not taxable as income but there are several cases in which a life insurance death benefit or policy benefits would be taxed. But most large sums of money like lottery winnings are subject to tax.

How Life Insurance Is Taxed Quotacy

How Life Insurance Is Taxed Quotacy

Learn whether youll have to pay taxes on life insurance.

Is life insurance money taxable. The question as to whether or not life insurance money is taxable has many different facets to it. This tax free exclusion also. It provides money to beneficiaries to pay for things like college a mortgage and more.

Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. If you have employer provided life insurance known as group life insurance any coverage over 50000 is treated as taxable income but any amount under 50000 is not taxed.

Some permanent policies build up cash value that you can pull from while you are living. Instead of withdrawing money from your life insurance policy you might consider taking a loan against the cash value of your policy. As with other loans the internal revenue service doesnt consider the amount of the loan to be taxable income when you withdraw it.

However any interest you receive is taxable and you should report it as interest received. Life insurance is one of the best ways to build a financial safety net. In other words it is not a simple question to answer.

Life insurance including death benefits is usually not taxable. See topic 403 for more information about interest. However there are situations when money from a tax benefit may get taxed.

That money isnt considered taxable income. Usually not but some scenarios do allow for the death benefit to be taxed. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it.

Some life insurance policies are used. Group life insurance can be a nice addition to your benefits package especially if its free or nearly free. So are life insurance proceeds taxable.

Your life insurance money if tied up in a permanent policy can be taxable during your life. When you talk about life insurance money you should talk about the premiums paid in and the benefits paid out.

Life Insurance Policy Payouts Are They Taxable Or Not Income

Life Insurance Policy Payouts Are They Taxable Or Not Income

Is Life Insurance Tax Deductible Northwestern Mutual

Is Life Insurance Tax Deductible Northwestern Mutual

Section 10 10d Of Income Tax Act On Payouts Of Life Insurance

Section 10 10d Of Income Tax Act On Payouts Of Life Insurance

Payroll Taxes And Employer Responsibilities

Payroll Taxes And Employer Responsibilities

Life Insurance Policies Income Tax On Life Insurance Policies

Life Insurance Policies Income Tax On Life Insurance Policies

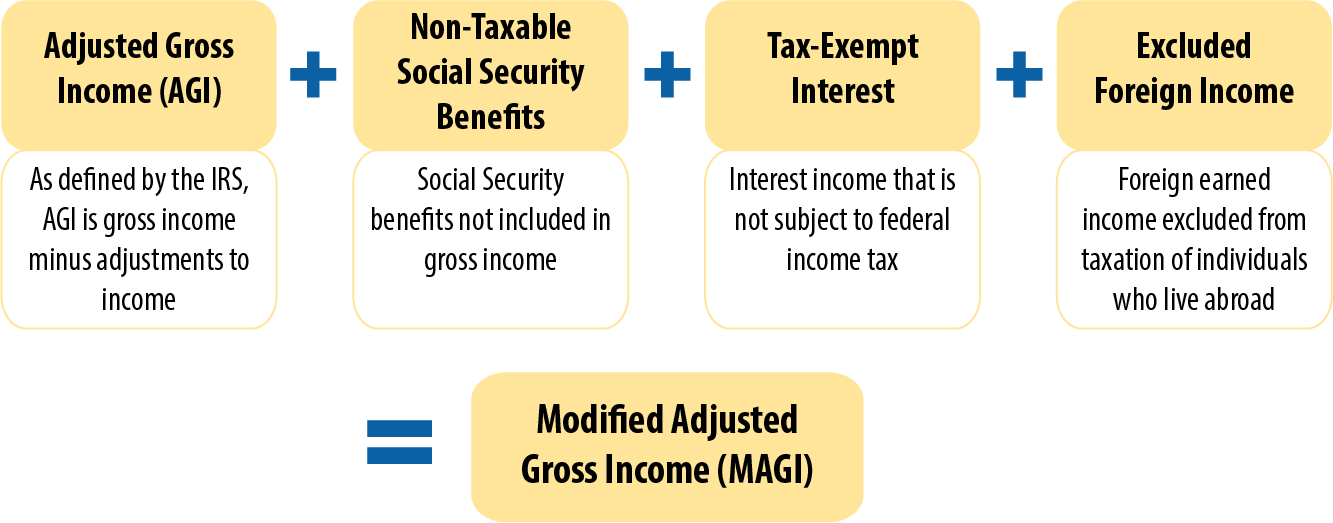

Key Facts Income Definitions For Marketplace And Medicaid

Key Facts Income Definitions For Marketplace And Medicaid

Toli Trustee Alert The Taxation Of A Life Settlement Policy Sale

Toli Trustee Alert The Taxation Of A Life Settlement Policy Sale

Is Life Insurance Payout Taxable In Canada Stingypig Ca

Is Life Insurance Payout Taxable In Canada Stingypig Ca

Is Life Insurance Taxable Visual Ly

Is Life Insurance Taxable Visual Ly

Taxes On Life Insurance Here S When Proceeds Are Taxable Bankrate

Taxes On Life Insurance Here S When Proceeds Are Taxable Bankrate

Life Insurance If I Cash In My Policy Will I Owe Tax Bankrate Com

Life Insurance If I Cash In My Policy Will I Owe Tax Bankrate Com

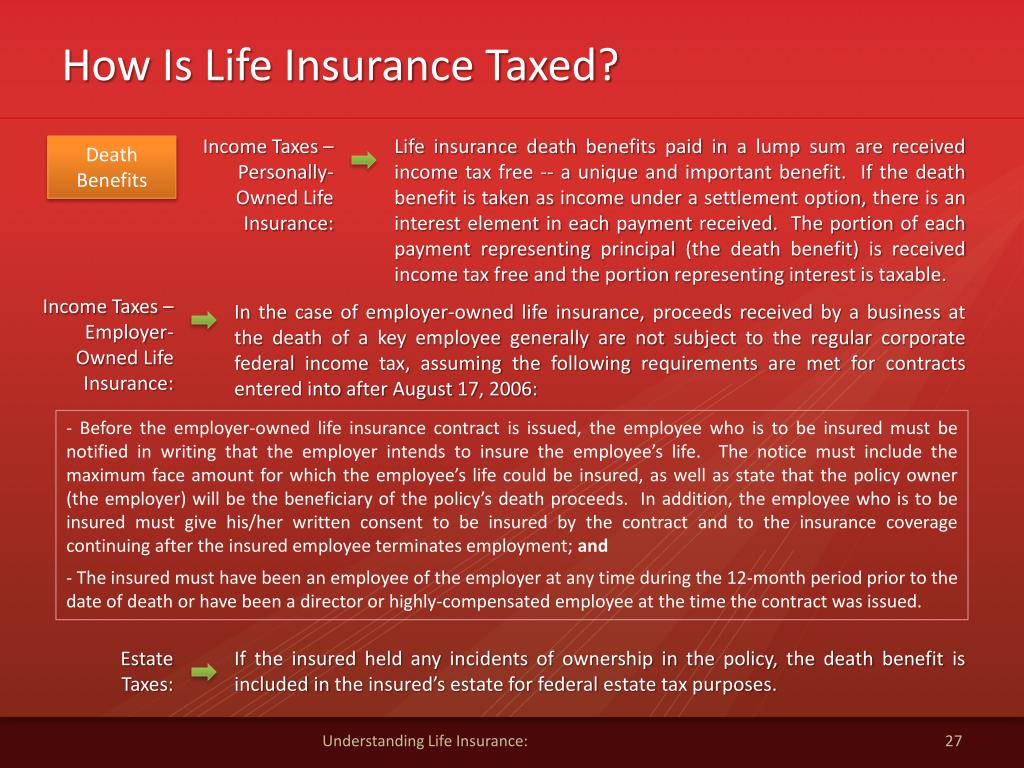

Ppt Understanding Life Insurance Powerpoint Presentation Free

Ppt Understanding Life Insurance Powerpoint Presentation Free

Corporate Life Insurance Opportunities To Die For

Corporate Life Insurance Opportunities To Die For

Is Life Insurance Taxable Allstate

Is Life Insurance Taxable Allstate

Your Full Guide To Viatical Settlements Explained Mason Finance

Your Full Guide To Viatical Settlements Explained Mason Finance

Unwinding An Irrevocable Life Insurance Trust That S No Longer

Unwinding An Irrevocable Life Insurance Trust That S No Longer

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

Life Insurance Policies Are Life Insurance Policies Taxed

Life Insurance Policies Are Life Insurance Policies Taxed

Malaysia Income Tax A Quick Guide To The Tax Reliefs You Can

Malaysia Income Tax A Quick Guide To The Tax Reliefs You Can

Is A Life Insurance Payout Considered Taxable Income My Senior

Is A Life Insurance Payout Considered Taxable Income My Senior

Do I Have To Pay Taxes On Life Insurance Payouts Life Insurance

Do I Have To Pay Taxes On Life Insurance Payouts Life Insurance

0 Komentar untuk "Is Life Insurance Money Taxable"