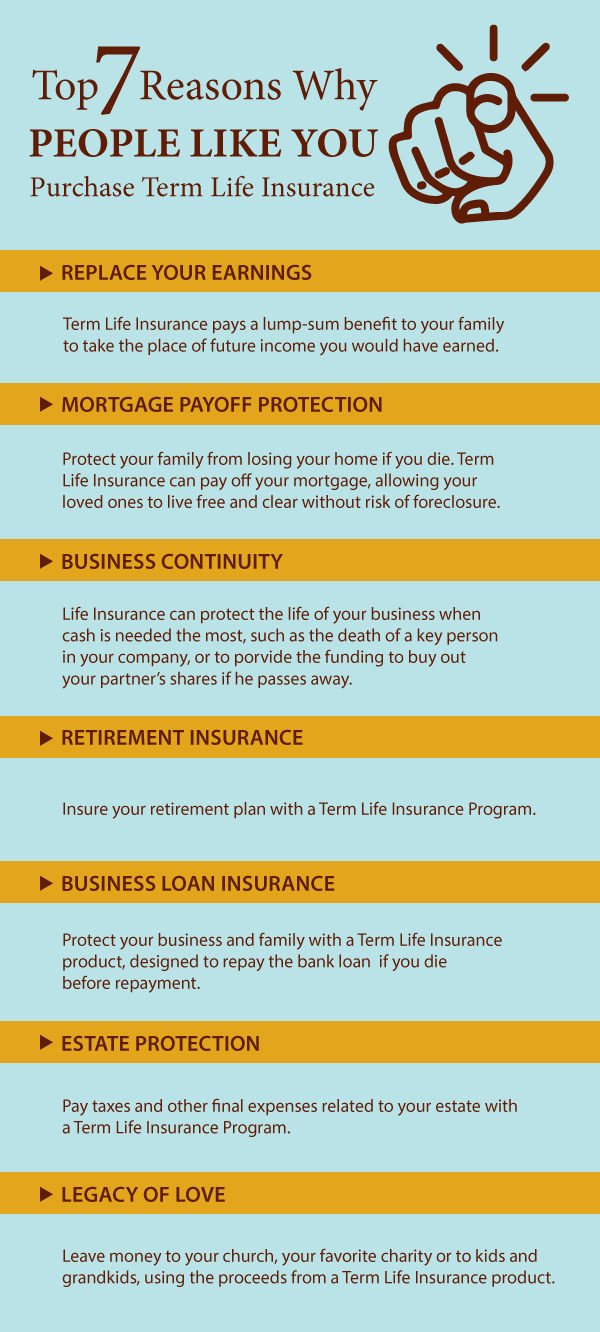

How borrowing from a life insurance policy works one of the greatest differences between policy loans and traditional loans is that you dont have to pay back the loan to your own insurance policy. Yes cashing out life insurance is possible.

Policy Loan Can I Take Loan Against Life Insurance Policy

Policy Loan Can I Take Loan Against Life Insurance Policy

One additional benefit of loans against life insurance policyis that the policy value does not change with the market as in the case of loans against gold or shares.

How to get a loan from life insurance policy. Can i cash in a life insurance policy. Borrowing from your life insurance policy can be a quick and easy way to get cash in hand when you need it. When it comes to life insurance many consumers find whole life insurance attractive because it typically offers a cash value amount.

You can only borrow against a permanent or whole life insurance policy. If you think taking a loan against your life insurance is something you may have to do in the future you probably want to get a whole life policy or an annuity. As cash value builds in a whole or universal life insurance policy policy holders can borrow against the accumulated fundslife insurance policy loans have one distinct advantage.

This feature may allow someone to use their life insurance as collateral for a loan or even take out a loan from their life insurance policy. The best ways to cash out a life insurance policy are to leverage cash value withdrawals take out a loan against your policy surrender your policy or sell your policy in a life settlement or viatical settlement. When you borrow based on the cash value of your life insurance policy you are borrowing money from the life insurance company.

How to borrow from your life insurance policy. Opting a loan against a life insurance policy is also known as pledging where a loan can be issued by the insurance companies itself or any other financial institutions. A term life insurance policy has no cash value and therefore doesnt allow you to take a loan against it.

But if you dont have the. The money goes. Whats different about term life insurance.

Whether it be for an emergency some needed home repairs or that cant miss investment opportunity just about everyone needs a quick infusion of cash now and then. Whats more loans against life insurance policy are becoming a popular choice for customers since a lower rate of interest is charged in comparison to a personal loan.

How Credit Impacts Your Life Insurance Policy Pacific Insurance

How Credit Impacts Your Life Insurance Policy Pacific Insurance

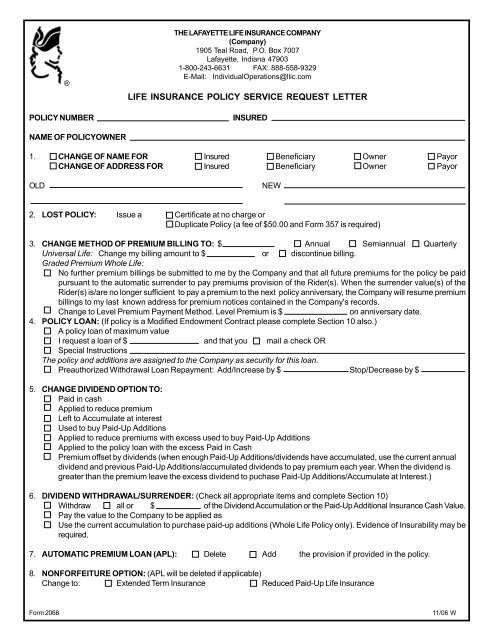

Life Insurance Policy Service Request Letter Secure Your Future

Life Insurance Policy Service Request Letter Secure Your Future

How To Borrow From Your Life Insurance Policy 10 Steps

How To Borrow From Your Life Insurance Policy 10 Steps

Make Term Life Insurance Permanent Before It S Too Late Bankrate Com

Make Term Life Insurance Permanent Before It S Too Late Bankrate Com

Loans Against Life Insurance Policies

Loans Against Life Insurance Policies

:max_bytes(150000):strip_icc()/shutterstock_241803703-5bfc3d8b4cedfd0026c592da.jpg) How Can I Borrow Money From My Life Insurance Policy

How Can I Borrow Money From My Life Insurance Policy

Types Of Life Insurance Policies Available In India Risk Benefits

Types Of Life Insurance Policies Available In India Risk Benefits

Helpful Techniques When Choosing Your Way Of Life Insurance Policy

Helpful Techniques When Choosing Your Way Of Life Insurance Policy

Life Insurance Online Life Insurance Plans Polices In India

Life Insurance Online Life Insurance Plans Polices In India

No B S Guide To 20 Year Term Life Insurance Rates Revealed Buy

No B S Guide To 20 Year Term Life Insurance Rates Revealed Buy

How To Borrow From Your Life Insurance Policy 10 Steps

How To Borrow From Your Life Insurance Policy 10 Steps

Life Insurance Loans A Risky Way To Bank On Yourself Financial

Life Insurance Loans A Risky Way To Bank On Yourself Financial

How Can I Get A Loan From My Life Insurance Policy Globe Life

How Can I Get A Loan From My Life Insurance Policy Globe Life

How To Borrow From Your Life Insurance Policy 10 Steps

How To Borrow From Your Life Insurance Policy 10 Steps

Life Insurance Loans Top Pros And Cons Of Borrowing From You Policy

Life Insurance Loans Top Pros And Cons Of Borrowing From You Policy

How To Get A Loan Against A Life Insurance Policy Indianmoney

How To Get A Loan Against A Life Insurance Policy Indianmoney

Women Bought 32 Of Life Insurance Policies In 2017 18 Shows

Women Bought 32 Of Life Insurance Policies In 2017 18 Shows

Group Life Insurance With Home Loan Things You Should Always Keep

Group Life Insurance With Home Loan Things You Should Always Keep

How Do Life Insurance Loans Work Glg America

How Do Life Insurance Loans Work Glg America

When Life Insurance Companies May Reject A Claim Nerdwallet

When Life Insurance Companies May Reject A Claim Nerdwallet

How Can Whole Life Insurance Premiums Remain Level Bank On Yourself

How Can Whole Life Insurance Premiums Remain Level Bank On Yourself

Want A Loan In Your Life Insurance Policy Keep These Things In

Want A Loan In Your Life Insurance Policy Keep These Things In

/Borrowing-money-from-a-life-insurance-policy-57afcb4d5f9b58b5c248b3c6.jpg)

0 Komentar untuk "How To Get A Loan From Life Insurance Policy"