150000 in your income by investing in life insurance products. You should buy life insurance only and only if you have any person dependent on you financially.

Ppt Understanding Life Insurance Powerpoint Presentation Free

Ppt Understanding Life Insurance Powerpoint Presentation Free

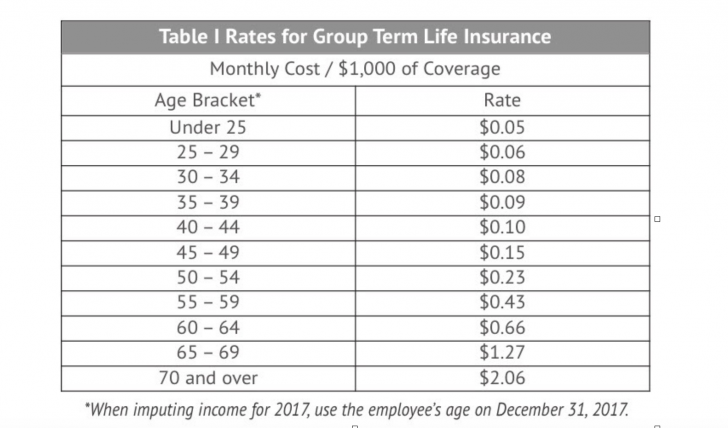

Employer paid life insurance may have a tax cost.

Income tax on life insurance benefits. Annuities allow you to establish an income. You can avail tax benefits. Or you have liability on your head.

Do not buy life insurance just because you get the income tax benefits. Income tax on life insurance benefits and annuities. This is the only tax benefit that is offered by all types of life insurance policies including term life and the various types of permanent life insurance.

Under section 80d of the income tax act 1961 allows tax benefits on health insurance premium. This most obvious tax benefit of life insurance is the fact that the beneficiaries of a life insurance death benefit do not pay income tax on the proceeds. Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout.

Under the current rules you can get a maximum deduction of rs. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. When you are reimbursed for a claim to repair your home or even replace it if its destroyed such as in a fire no tax is owed.

Are life insurance proceeds taxable. So if your life insurance plan has health related inbuilt or add on cover such as critical illness rider surgical care rider hospital care rider etc. The premium cost for the first 50000 of life insurance coverage provided under an employer provided group term life insurance plan does not have to be reported as income and is not taxed to you.

This tax free exclusion also. Life insurance provides a way for you to secure the financial future of your heirs after your death. Under section 80c of the income tax act investments in certain products like life insurance make you eligible to claim a deduction in your overall tax.

Purchase a life insurance policy which you feel is suitable for you as it not only offers you protection but also offers tax benefits under section 80c of the income tax act 1961 and section 1010d of the income tax act 1961.

Health Insurance Tax Benefits U S 80d For Fy 2018 19 Ay 2019 20

Health Insurance Tax Benefits U S 80d For Fy 2018 19 Ay 2019 20

Tax Saving How Life Insurance Can Help You Save Tax Under Section

Tax Saving How Life Insurance Can Help You Save Tax Under Section

Holding Insurance Within Superannuation Money Management

Holding Insurance Within Superannuation Money Management

Life Insurance Policies Income Tax On Life Insurance Policies

Life Insurance Policies Income Tax On Life Insurance Policies

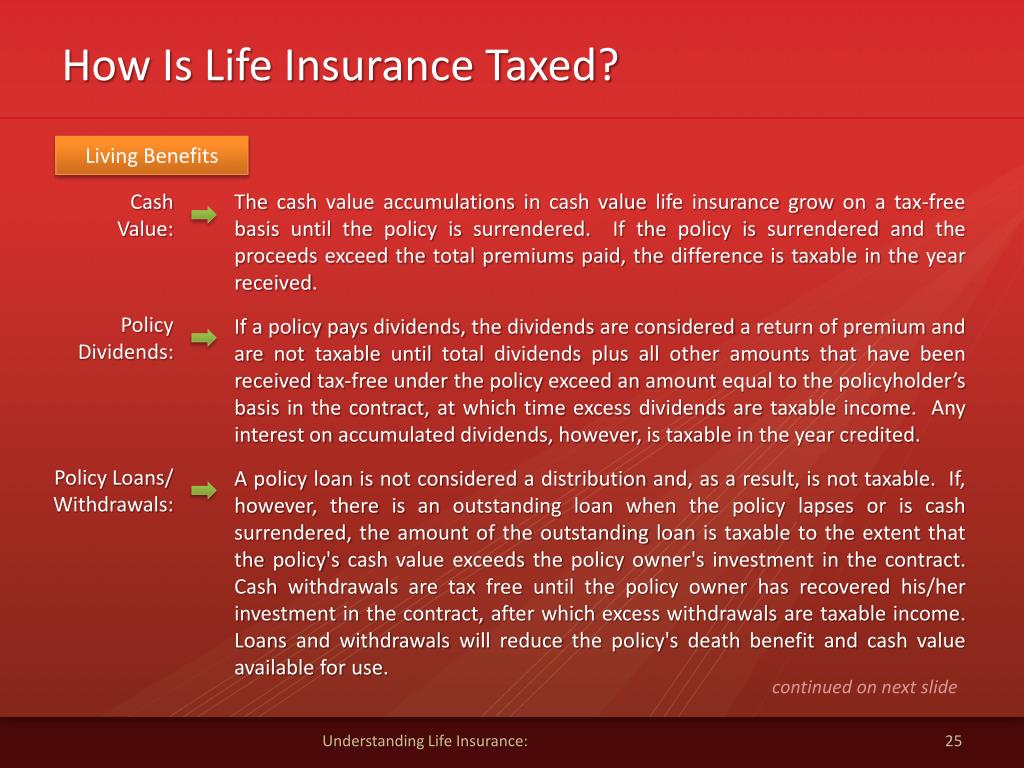

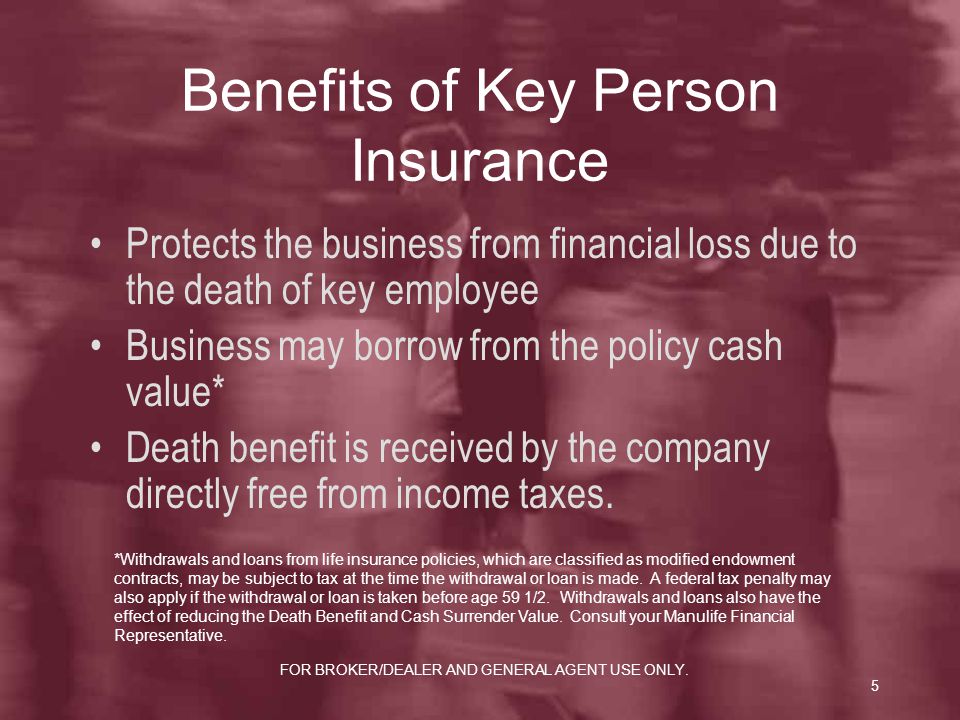

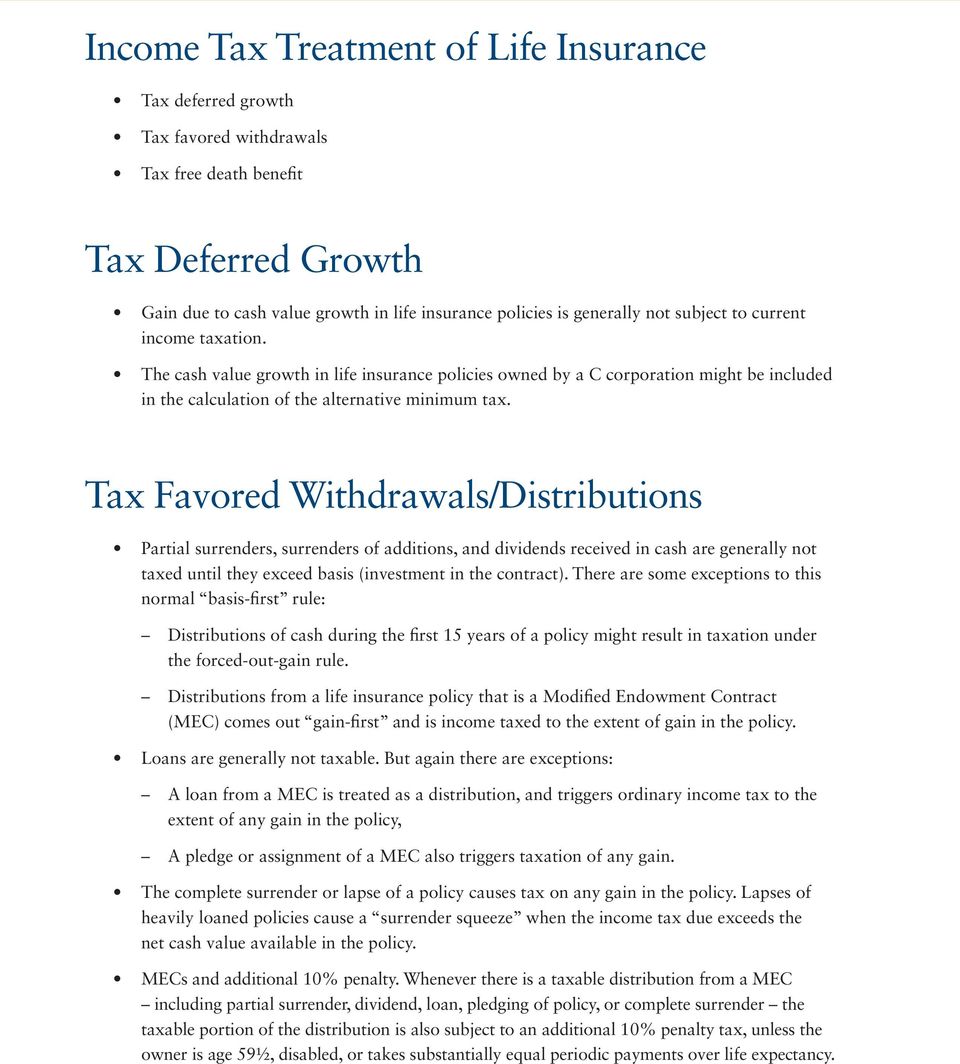

Life Insurance Income Taxation In Brief Pdf Free Download

Life Insurance Income Taxation In Brief Pdf Free Download

Income Tax Deduction And Exemption To Insurance Policy Planmoneytax

Income Tax Deduction And Exemption To Insurance Policy Planmoneytax

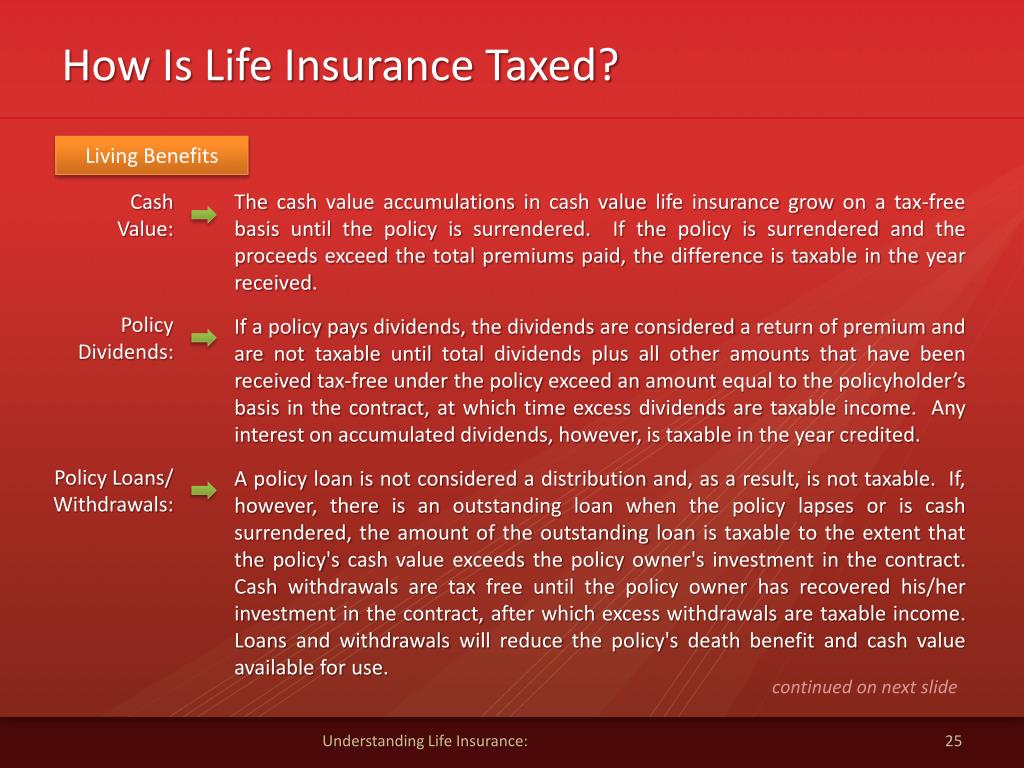

Business Planning Using Life Insurance Ppt Download

Business Planning Using Life Insurance Ppt Download

Golocalworcester Smart Benefits Imputed Income For Group Term

Golocalworcester Smart Benefits Imputed Income For Group Term

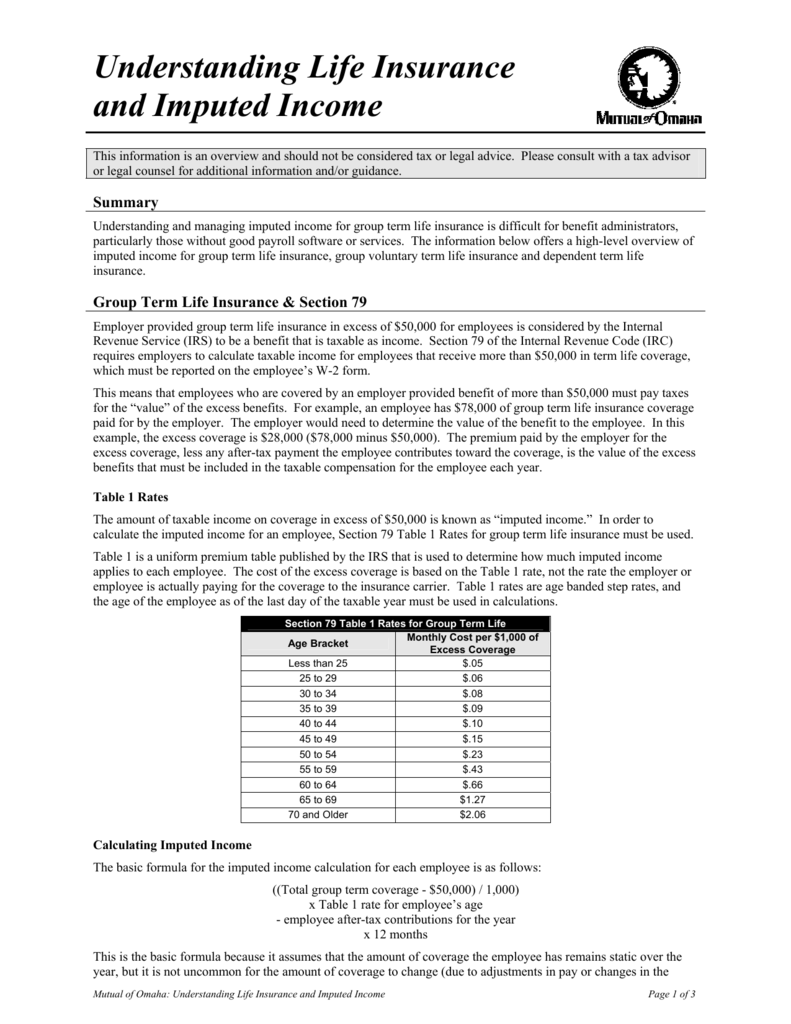

Understanding Life Insurance And Imputed Income

Understanding Life Insurance And Imputed Income

Tax Benefits On Insurance Policies Cheap Term Life Insurance

Tax Benefits On Insurance Policies Cheap Term Life Insurance

Group Term Life Insurance Irs Regulations

Group Term Life Insurance Irs Regulations

Should You Buy Life Insurance To Save Taxes Investor Education

Should You Buy Life Insurance To Save Taxes Investor Education

Life Insurance In A Changing Tax Environment M Financial

Life Insurance In A Changing Tax Environment M Financial

Tip With Sip Makes Your Family Secure With Less Worries The

Tip With Sip Makes Your Family Secure With Less Worries The

Are Life Insurance Death Benefits Taxable Income Finance Zacks

Are Life Insurance Death Benefits Taxable Income Finance Zacks

Tax Saving Investments Up To Rs 62 400 May Be Saved By Investing

Tax Saving Investments Up To Rs 62 400 May Be Saved By Investing

How Lic Policy Can Save You Income Tax Income Tax Exemption Law

How Lic Policy Can Save You Income Tax Income Tax Exemption Law

Life Insurance Policies Income Tax On Life Insurance Policies

Life Insurance Policies Income Tax On Life Insurance Policies

Excluded Items From Gross Income Fringe Benefits Federal Income

Excluded Items From Gross Income Fringe Benefits Federal Income

0 Komentar untuk "Income Tax On Life Insurance Benefits"