The imputed income occurs when individuals with more than 50000 of life coverage volume insurance pay less for the coverage than the irs has determined to be worth as per the. Cuenca associates insurance agency inc dba lifehelp is licensed to transact business in all 50 states and the district of columbia and is domiciled at 2990 innsbruck drive redding ca 96003.

How To Calculate Imputed Tax Chron Com

How To Calculate Imputed Tax Chron Com

This coverage is excluded as a de minimis fringe benefit.

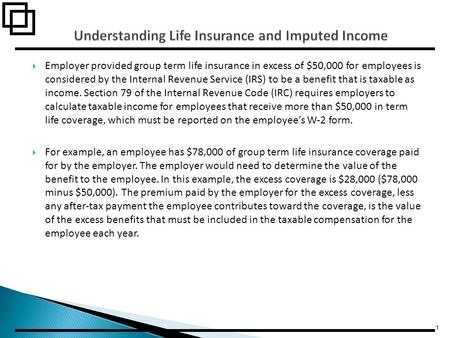

Imputed income life insurance calculator. Imputed income is the taxable value of group life insurance over 50000 that is provided to employees. So what is it and how does it work. It applies whenever you provide an employee more than 50000 worth of life insurance.

There are a number of calculators on the internet that will calculate imputed income for you by you inputting several variables. Use this form to calculate how much imputed income you will have. If you provide group term life insurance to your employees you might need to think about imputed income.

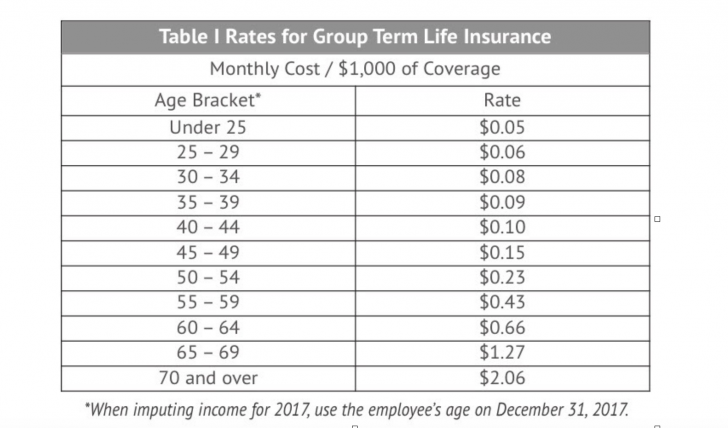

Imputed income is the dollar value that irs puts on the amount of group term life insurance coverage in excess of 50000. The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000. For example if you are 50 years old and the life insurance policy is 60000 you subtract the 50000 which leaves 10000.

Life insurance imputed income calculation. The taxes on the imputed income are deducted from your biweekly paycheck. Group term life insurance imputed income worksheet msk paid basic life insurance coverage above 50000 causes taxable imputed income on the value of the coverage.

Basic life insurance imputed income calculation worksheet the irs says that employer paid life insurance amounts in excess of 50000 is considered taxable income to you. According to internal revenue service section 79 if an employee receives more than 50000 of group term life insurance under a policy carried by his employer the imputed cost of coverage over 50000 is considered taxable income and is subject to social security and medicare taxes. There is a simple formula that is available which will help you calculate the amount of imputed income for life insurance so that youll know what is needed to be paid.

If you have additional questions regarding. Marvell basic life insurance plan pays 25 times your salary. Youre probably familiar with the concept of providing pre tax benefits to your employees such as.

California agency license 0449782 arkansas agency license 247784. You are taxed based on the value of the benefit not the benefit itself. Imputed income amounts for basic and voluntary life plans are calculated using the volume of coverage on the plan v and an age banded rate r which is determined by the irs using the employees age on the last day of the employees tax year.

How To Calculate The Imputed Income On A Company Car Chron Com

How To Calculate The Imputed Income On A Company Car Chron Com

Adjusting Imputed Income For U S Group Term Life Insurance

Adjusting Imputed Income For U S Group Term Life Insurance

The Best Retirement Calculators Online Pt Money

The Best Retirement Calculators Online Pt Money

Employer Provided Group Term Life Insurance In Excess Of 50 000

Employer Provided Group Term Life Insurance In Excess Of 50 000

How To Calculate Child Support In California 2020 Guide

How To Calculate Child Support In California 2020 Guide

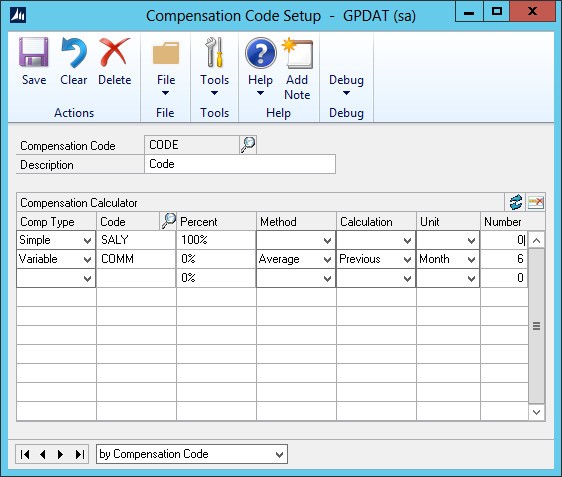

Life Insurance Tax Calculator Imputed Income For Dynamics Gp

Life Insurance Tax Calculator Imputed Income For Dynamics Gp

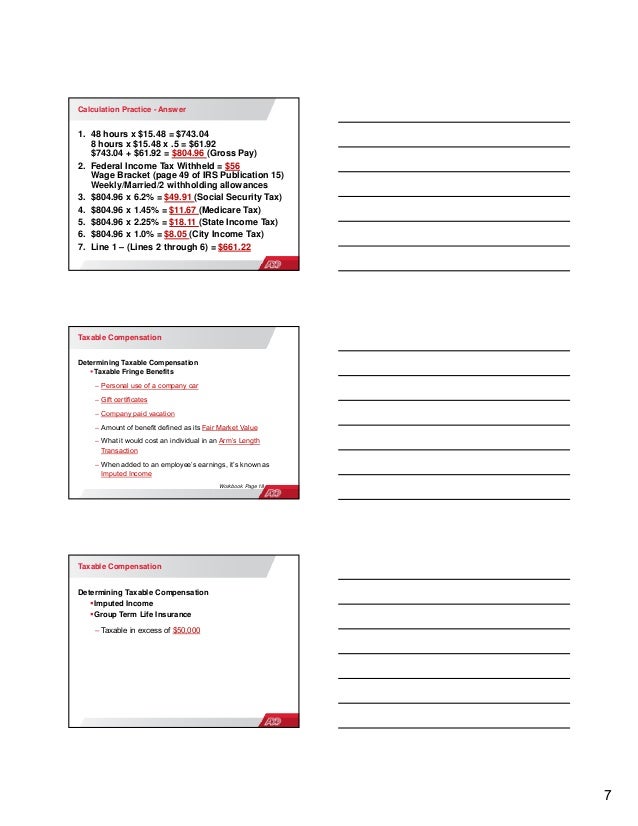

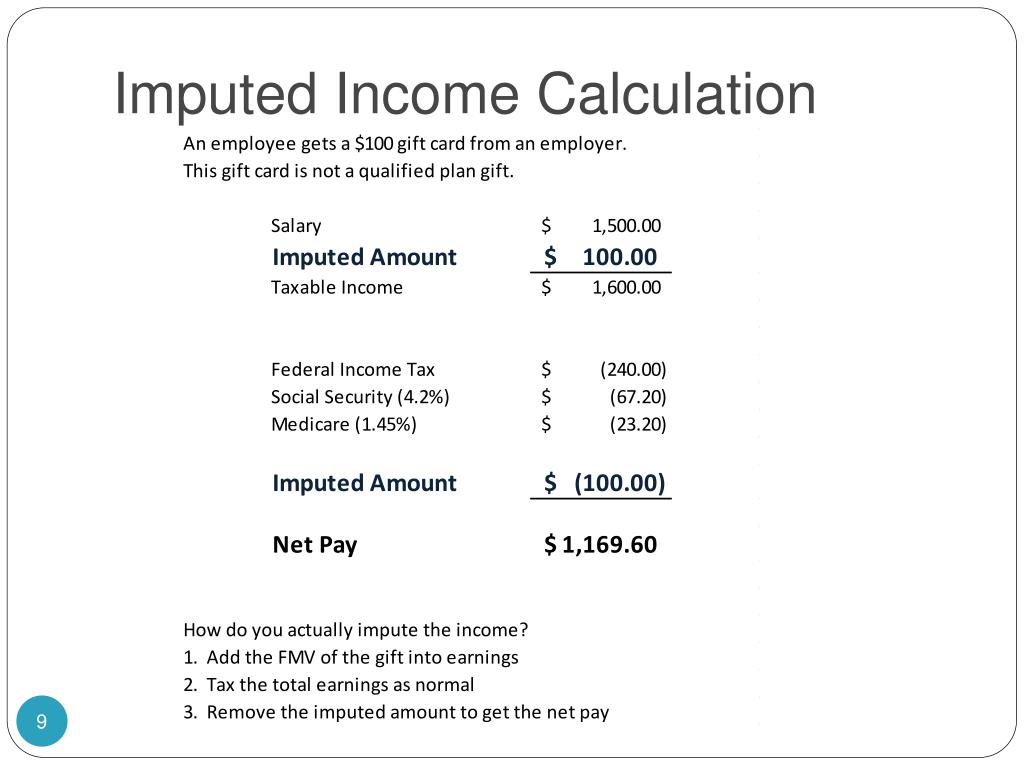

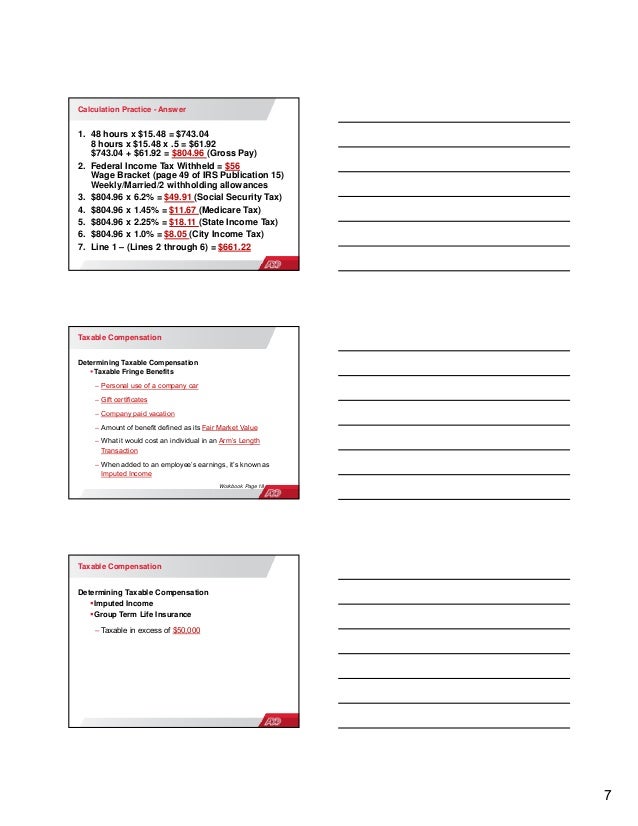

2015 College For Financial Planning All Rights Reserved Session

2015 College For Financial Planning All Rights Reserved Session

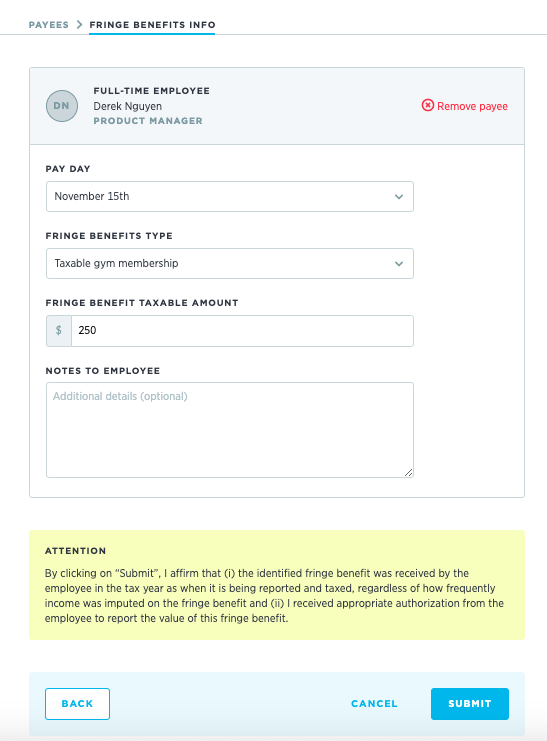

Fringe Benefits Justworks Help Center

Fringe Benefits Justworks Help Center

Ppt Compensation Benefits Is It All Taxable Income

Ppt Compensation Benefits Is It All Taxable Income

Group Life Insurance Group Life Insurance Imputed Income

Group Life Insurance Group Life Insurance Imputed Income

Https Files Hudexchange Info Resources Documents Cpdincomeeligibilitycalculator User Manual Pdf

Taxation Of Group Term Life Insurance White Papers Mcgriff

Taxation Of Group Term Life Insurance White Papers Mcgriff

Domestic Partner Benefits Human Resources University Of Pittsburgh

How To Set Up Sap Hcm Configuration For Imputed Income Calculation

How To Set Up Sap Hcm Configuration For Imputed Income Calculation

Golocalworcester Smart Benefits Imputed Income For Group Term

Golocalworcester Smart Benefits Imputed Income For Group Term

How To Calculate Imputed Income For Domestic Partner Benefits

How To Calculate Imputed Income For Domestic Partner Benefits

Group Life Insurance Group Life Insurance Imputed Income

Group Life Insurance Group Life Insurance Imputed Income

Payroll Fundamentals Presentation

Payroll Fundamentals Presentation

0 Komentar untuk "Imputed Income Life Insurance Calculator"