Life insurance for company directors. Likewise f the employee is the benificiary then its a taxable benefit which should be reported on form p11d.

Calculating Imputed Income On Group Term Life Insurance Goco Io

Calculating Imputed Income On Group Term Life Insurance Goco Io

12112012 many businesses own life insurance on employees and owners and designate the business as beneficiary of the policy.

Is company paid life insurance taxable. This coverage is excluded as a de minimis fringe benefit. Whether any company provided life insurance you receive is taxable depends on the type the amount and the beneficiaries of the insurance proceeds. The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000.

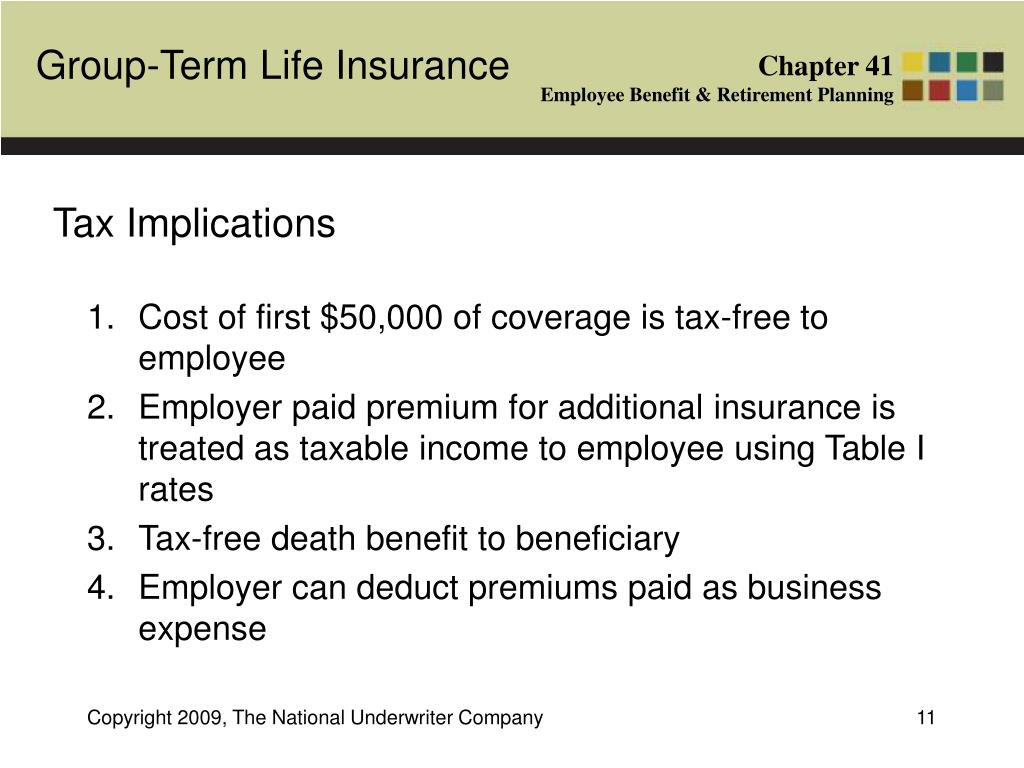

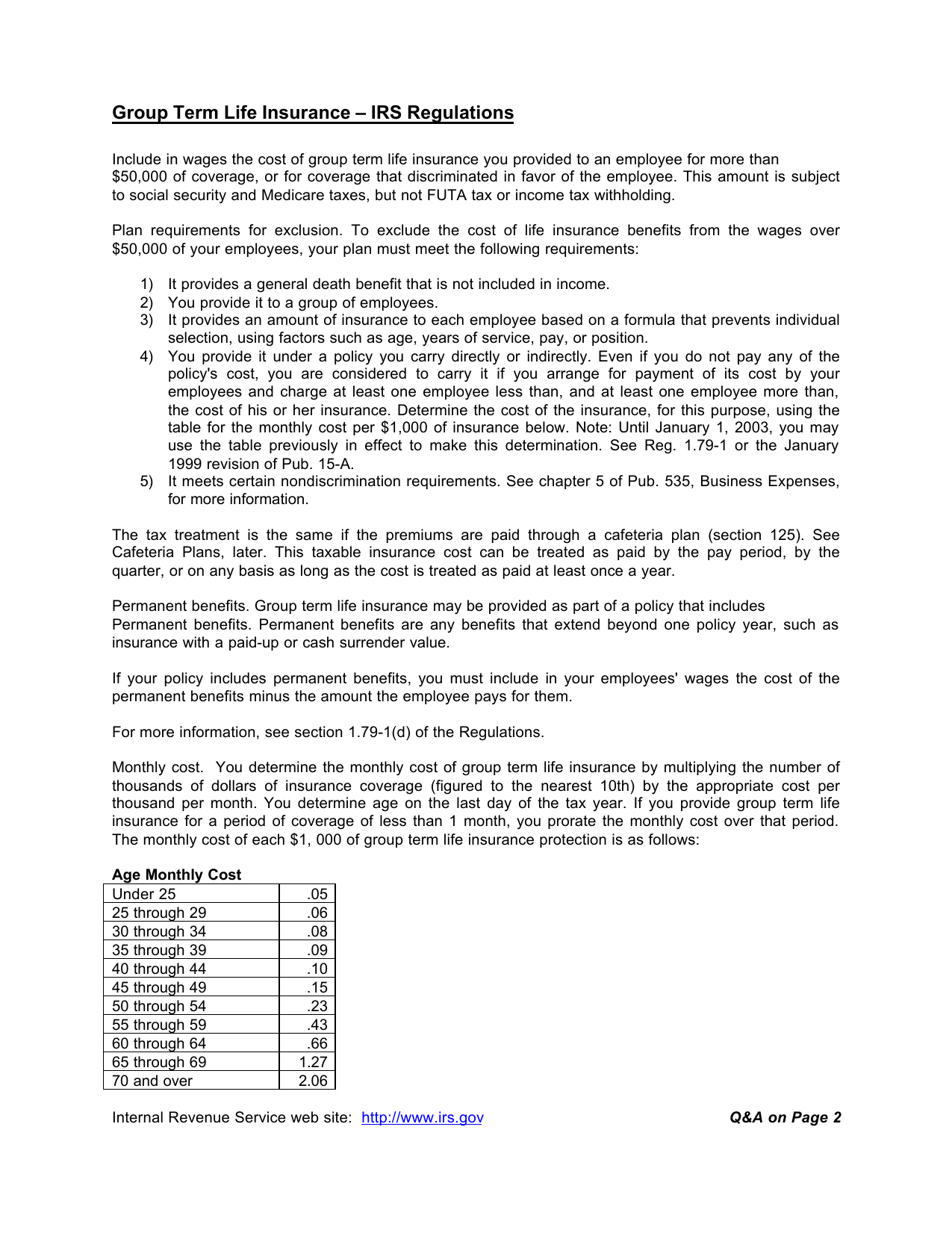

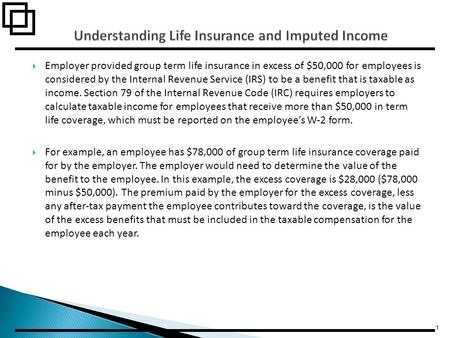

Are company paid insurance premiums taxable income. The premium cost for the first 50000 of life insurance coverage provided under an employer provided group term life insurance plan does not have to be reported as income and is not taxed to you. Employer paid life insurance premiums covering the first 50000 in insurance are not taxable to you.

Business owned life insurance may be taxable. Some benefits for sickness and accidents may be. Under the federal affordable care act employers must start reporting the cost of your coverage on your form w 2.

But premiums your employer pays for any face amount of insurance over 50000 are treated by the internal revenue service as income paid to you and you will have to pay income tax on this amount. This is not going to increase your taxes so dont panic. Life insurance proceeds are usually not subject to state and.

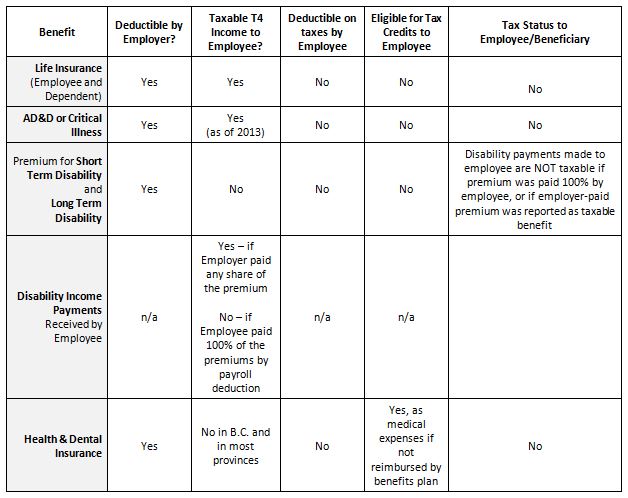

They do this in order to protect the entity from the loss of a key person or to provide funding for a buy sell agreement. Premiums your employer pays for health accident or disability insurance arent taxable income. If a company provides benefits to its employees the business might also be providing taxable income that employees must report to the internal.

If this is the case then the cost of the insurance will become part of the employees overall remuneration package. Besides income tax withholding there might also. In most cases the cost of the insurance paid by the company is deemed to be an allowable business expense.

Employer paid life insurance may have a tax cost. It was always my understanding that if an employer is the beneficiary of a life insurance policy then no p11d benefit will arise. When a person insured by a life insurance policy dies while the policy is in force the death benefit is paid to the beneficiary.

Are Life Insurance Premiums Paid By Employer Taxable

Are Life Insurance Premiums Paid By Employer Taxable

Health Insurance Tax Would Cost Insurers 15 5 Billion In 2020

Health Insurance Tax Would Cost Insurers 15 5 Billion In 2020

Ppt What Is It Powerpoint Presentation Free Download Id 3224370

Ppt What Is It Powerpoint Presentation Free Download Id 3224370

Maybe You Are Insurable Contractor

Maybe You Are Insurable Contractor

Is Life Insurance Tax Deductible Northwestern Mutual

Is Life Insurance Tax Deductible Northwestern Mutual

An Advisor S Guide To Employer Owned Life Insurance And Section

An Advisor S Guide To Employer Owned Life Insurance And Section

Is Life Insurance Taxable Allstate

Is Life Insurance Taxable Allstate

Group Term Life Insurance Irs Regulations

Group Term Life Insurance Irs Regulations

Taxation In The United States Wikipedia

Taxation In The United States Wikipedia

Can I Sell My Life Insurance Policy All For Cash Mason Finance

Can I Sell My Life Insurance Policy All For Cash Mason Finance

Are Life Insurance Premiums Tax Deductible Quotacy

Are Life Insurance Premiums Tax Deductible Quotacy

Life Insurance Basis Isn T Reduced By Cost Irs Says Law360

Life Insurance Basis Isn T Reduced By Cost Irs Says Law360

2015 College For Financial Planning All Rights Reserved Session

2015 College For Financial Planning All Rights Reserved Session

Agencyone S Oneidea Intergenerational Family Loans With

Agencyone S Oneidea Intergenerational Family Loans With

Publication 575 2018 Pension And Annuity Income Internal

Publication 575 2018 Pension And Annuity Income Internal

Rpp Benefits Taxation Of Benefit Plans

Rpp Benefits Taxation Of Benefit Plans

Are Company Paid Insurance Premiums Taxable Income Finance Zacks

Are Company Paid Insurance Premiums Taxable Income Finance Zacks

Foreign Life Insurance Taxable Income Fbar Reportable

Foreign Life Insurance Taxable Income Fbar Reportable

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

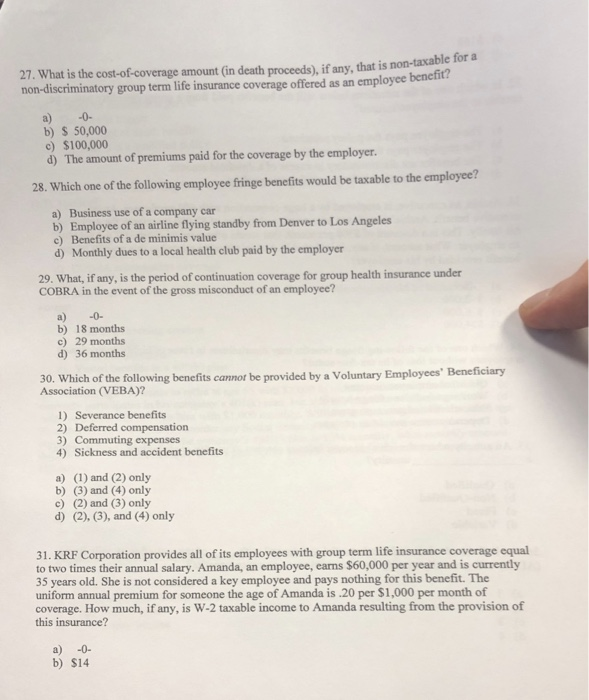

Solved 27 What Is The Cost Of Coverage Amount Gin Death

Solved 27 What Is The Cost Of Coverage Amount Gin Death

Blog The Tunstall Organization Inc The Tunstall Organization

Blog The Tunstall Organization Inc The Tunstall Organization

0 Komentar untuk "Is Company Paid Life Insurance Taxable"