Some policies have a final maturity date when the cash value equals the death benefit. Cash value life insurance provides permanent coverage with a savings component.

Difference Between Cash Value And Face Value In Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

The cash value of a policy may also grow because of earnings.

How does whole life insurance work cash value. Cash value life insurance also known as permanent life insurance includes a death benefit in addition to cash value accumulation. Whole life insurance is a type of permanent life insurance that offers cash value. Under term life insurance you pay premiums for a set number of years and the insurance expires after a set period of time paying no benefit if you do not die during that period.

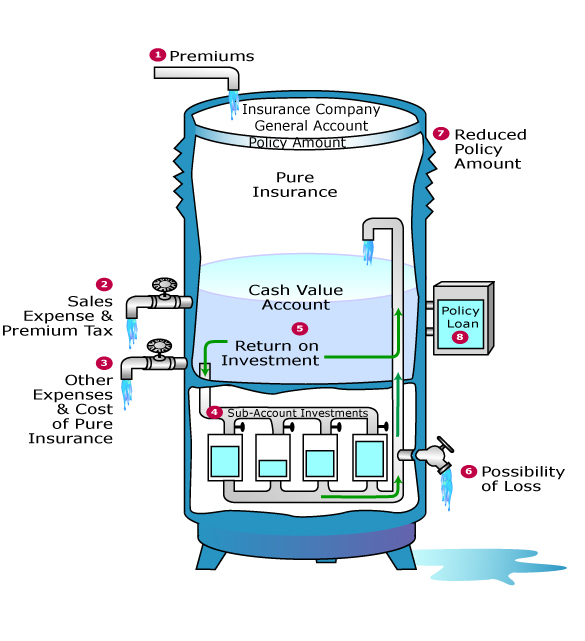

Cash value life insurance is a policy that contains an account that builds value cash value over time. Some of your whole life premiums go toward building up cash value which gradually replaces insurance in guaranteeing the death benefit. So in that way it can be seen as a kind of investment as well as a way to provide for loved ones after the die.

Term life insurance policies have no cash surrender value so if you decide to give up your coverage to the insurer you wont receive anything in return. These policies allow you to build up cash that you can tap into while youre alive. If youve built up a sizable cash value you may also choose to take out a loan against your policylife insurance companies often offer these cash value loans at interest rates lower than a.

Whole life policies offer guaranteed cash value accounts that increase based on a formula determined by the insurance company. Youll also earn interest on the cash value of your policy every year. How does cash value life insurance work.

While variable life whole life and universal life insurance. Life insurance provides a death benefit for the policys beneficiaries. On the other hand its also the reason why term life insurance is several times less expensive than cash value life insurance.

Cash value is built into a whole life insurance policy allowing the policy to be treated more like a long term investment. It works by taking a part of your premium payment and putting it into to the account. To learn more and to discover what an insurance strategy based on a properly designed whole life insurance policy can do for you request your free no obligation analysis today.

Often the overall growth of the whole life insurance policys cash value can actually be boosted with this strategy. What is whole life insurance. Guarantees are subject to the claims paying ability of the insurer universal life policies offer cash value accounts that track current interest rates.

Whole Life Insurance Growth Chart Parta Innovations2019 Org

Whole Life Insurance Growth Chart Parta Innovations2019 Org

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg) Whole Life Insurance Definition

Whole Life Insurance Definition

The 7702 Plan Defined By Certified Financial Planner Neil Jesani

The 7702 Plan Defined By Certified Financial Planner Neil Jesani

What Happens To Your Policy S Cash Value After You Die

What Happens To Your Policy S Cash Value After You Die

What Is Whole Life Insurance An Insurance Policy With No Expiry

Chapter4 Life Insurance Policies Provisions Options And Riders

Chapter4 Life Insurance Policies Provisions Options And Riders

Cash Value Life Insurance For Your Child Grow Up Plan Gerber

Cash Value Life Insurance For Your Child Grow Up Plan Gerber

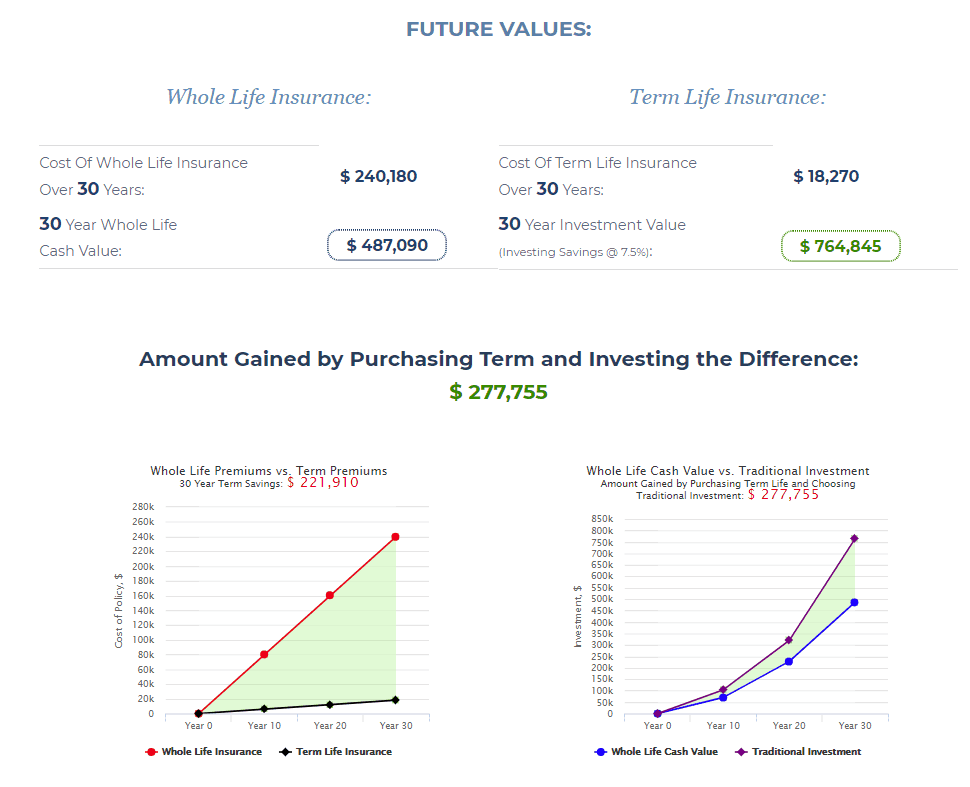

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

What Is Whole Life Insurance And How Does It Work

What Is Whole Life Insurance And How Does It Work

Don T Be Confused Here S The Gist Of Term Vs Whole Life

Don T Be Confused Here S The Gist Of Term Vs Whole Life

Universal Life Insurance Definition

Universal Life Insurance Definition

Is Life Insurance An Asset Why It May Be The Most Important Asset

Is Life Insurance An Asset Why It May Be The Most Important Asset

Understanding Whole Life Insurance Dividend Options

Understanding Whole Life Insurance Dividend Options

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Usaa Whole Life Insurance Review Not Your Best Whole Life

Usaa Whole Life Insurance Review Not Your Best Whole Life

Term Conversion Convert To Term To Permanent Whole Life

Term Conversion Convert To Term To Permanent Whole Life

How Cash Value Builds In A Life Insurance Policy

How Cash Value Builds In A Life Insurance Policy

Why Whole Life Insurance Is A Bad Investment

Why Whole Life Insurance Is A Bad Investment

Whole Life Insurance Cash Value Chart

Instant Whole Life Insurance Quotes Up To 100 000 In Coverage

Instant Whole Life Insurance Quotes Up To 100 000 In Coverage

Variable Universal Life Insurance Vul Success Financial Freedom

Variable Universal Life Insurance Vul Success Financial Freedom

0 Komentar untuk "How Does Whole Life Insurance Work Cash Value"