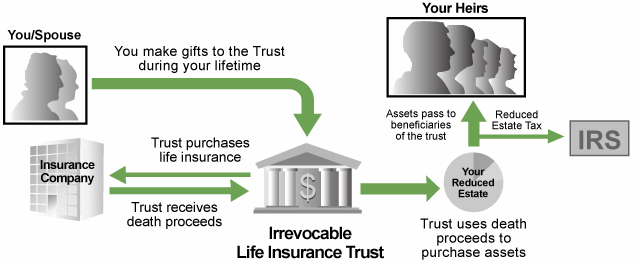

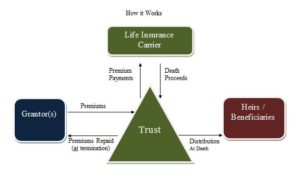

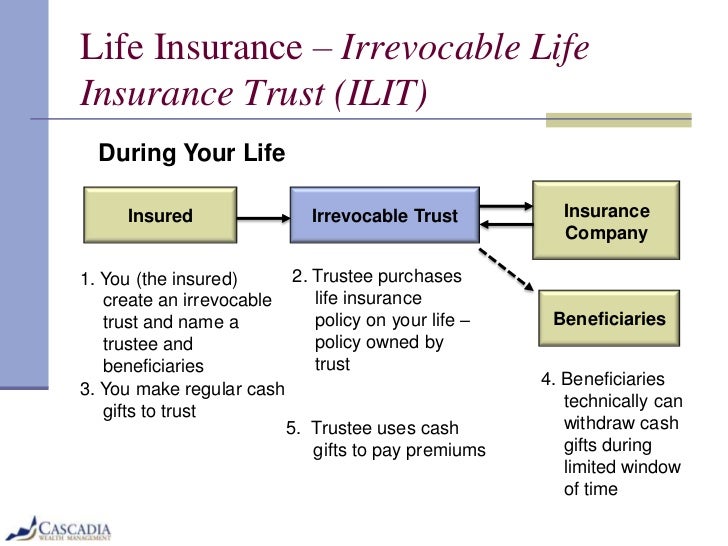

An irrevocable life insurance trust ilit takes ownership of your life insurance policy so the proceeds dont become part of your taxable estate. This is for two reasons.

Senior Life Insurance Life Insurance Living Trust

Senior Life Insurance Life Insurance Living Trust

It owns your life insurance policy for you removing it from your estate.

Irrevocable life insurance. Some may say that this approach be rendered obsolete if the federal estate tax is repealed. Ilits are constructed with a life insurance policy as the asset owned by the trust. This kind of life insurance trust helps to make sure your life insurance is paid out to your beneficiaries and not used to cover estate tax expenses.

Ilits can help you save a bundle in estate taxes. Irrevocable life insurance trusts ilit have been a sought after estate planning strategy. Whats an irrevocable life insurance trust and why do i need one.

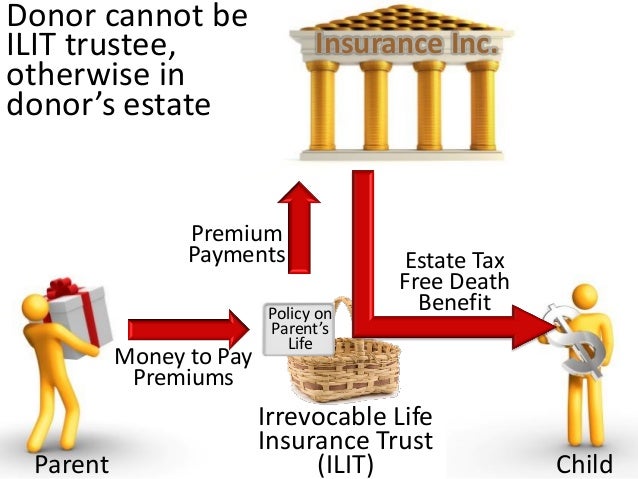

Like most trusts is simply a holding device. That means once youve created it and placed an insurance policy inside it you cant take the policy back in your own name. Once youve created an irrevocable life insurance trust you cant serve as a trustee on the policy.

Learn more about these and other reasons to own an ilit. Its important to restate. Life insurance policies can have either a revocable or irrevocable beneficiary designation.

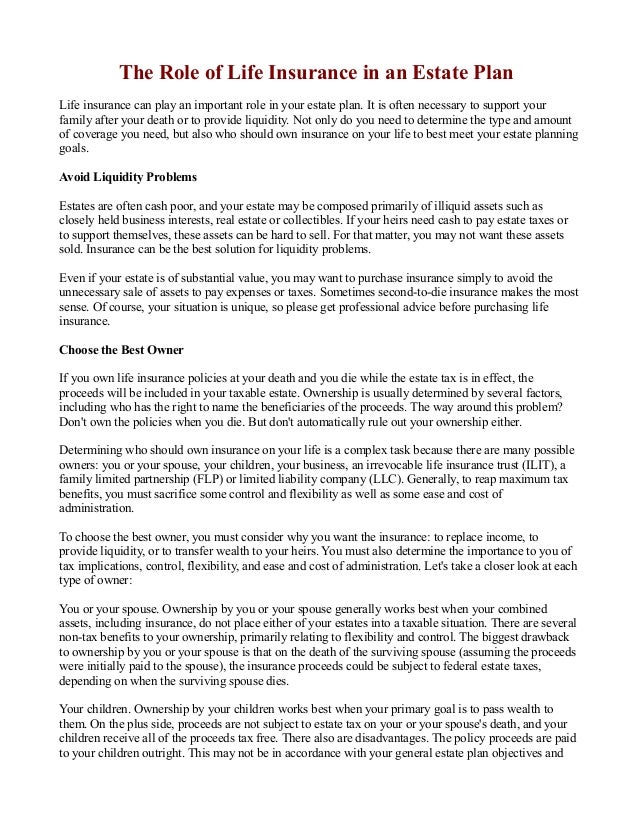

As its name suggests the irrevocable life insurance trust ilit is irrevocable. Posted on september 8 2011 and updated december 4 2018 in life insurance canada news 3 min read. Or is this still an important strategy to consider regardless of looming changes.

An irrevocable life insurance trust ilit helps minimize estate and gift taxes provides creditor protection and protects government benefits. When you purchase a life insurance policy you choose one or more beneficiaries who will get the policy pay out when you dieif you designate someone as the irrevocable beneficiary of your policy that person has the right to a pay out no matter whatyou cant remove that persons name from the policy even if you have a falling out or get divorced without his or her consent. What is an irrevocable life insurance trust.

An irrevocable life insurance trust ilit is a trust that cannot be rescinded amended or modified post creation. An irrevocable life insurance trust ilit is a special trust which serves as both the owner and beneficiary of one or more life insurance policieswhen it comes down to it an ilit is primarily a financial planning and estate planning tool that is used for to protect assets specifically a large life insurance death benefit from being subject to estate taxes.

Estate Planning Toolkit Archives Premier Trust

Estate Planning Toolkit Archives Premier Trust

Grantor Access To Funds In An Irrevocable Life Insurance Insmark

Grantor Access To Funds In An Irrevocable Life Insurance Insmark

The Pros And Cons Of An Irrevocable Life Insurance Trust

The Pros And Cons Of An Irrevocable Life Insurance Trust

Irrevocable Life Insurance Trust Faq

Irrevocable Life Insurance Trust Faq

Irrevocable Life Insurance Trust Pacific Beach Probate Law

Irrevocable Life Insurance Trust Pacific Beach Probate Law

Irrevocable Life Insurance Trust Ilit The Wealth Counselor

Irrevocable Life Insurance Trust Ilit The Wealth Counselor

Latest Iowa Lawyer Issue Read Gflf S Article On Irrevocable Life

Latest Iowa Lawyer Issue Read Gflf S Article On Irrevocable Life

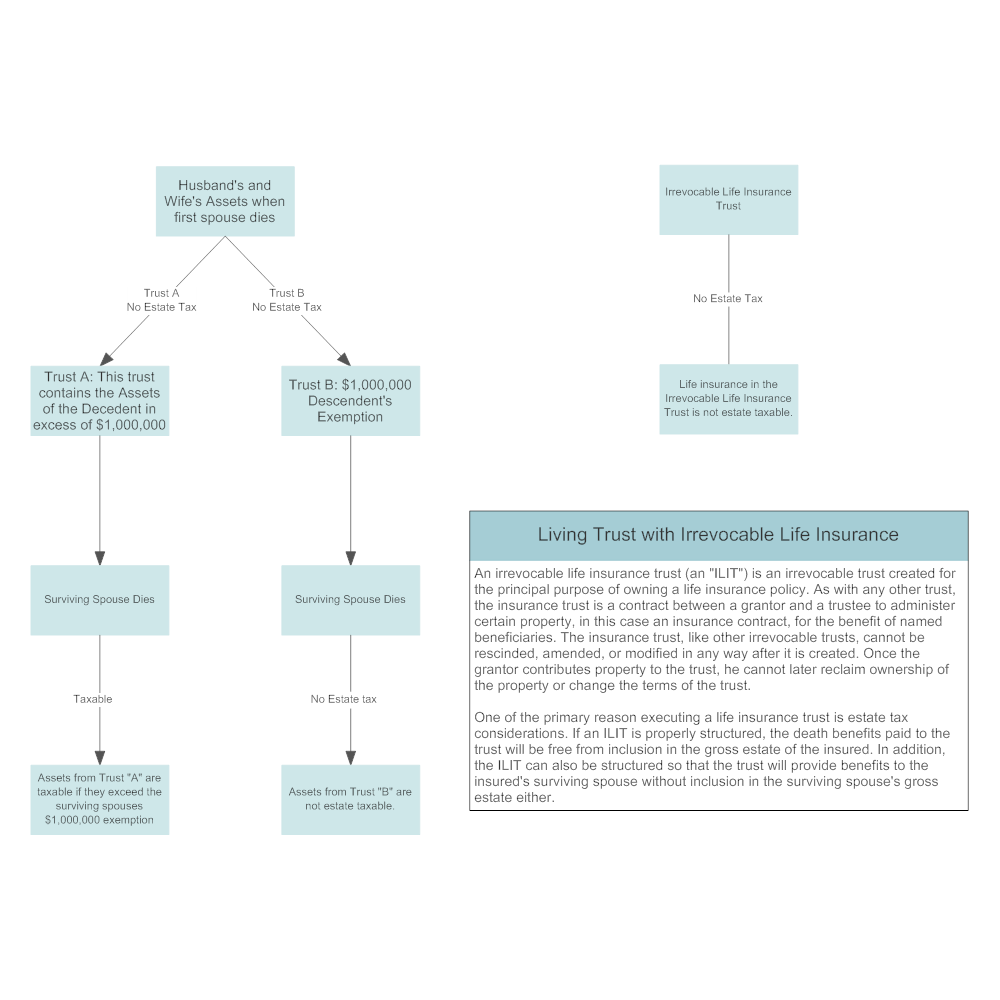

Living Trust With Irrevocable Life Insurance

Living Trust With Irrevocable Life Insurance

Ilit Irrevocable Life Insurance Trust In Business Finance By

Ilit Irrevocable Life Insurance Trust In Business Finance By

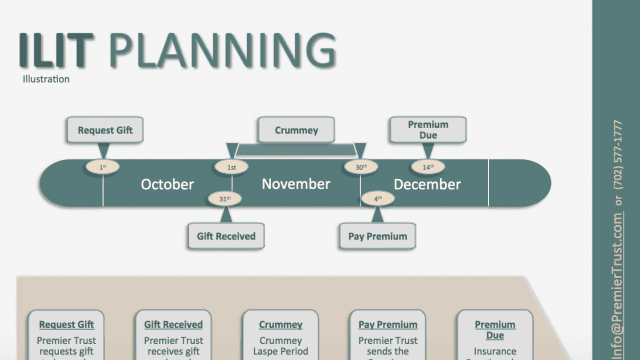

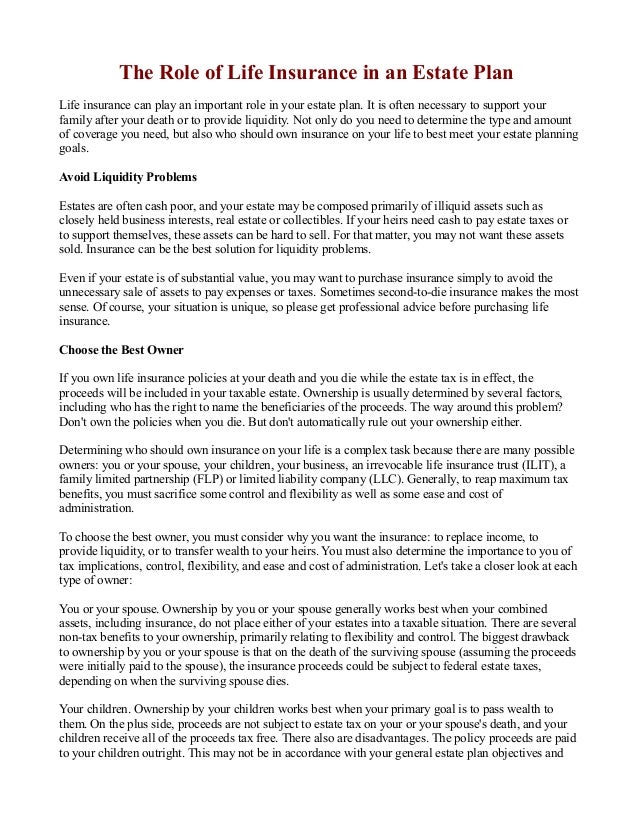

Ian Filippini The Role Of Life Insurance In An Estate Plan

Ian Filippini The Role Of Life Insurance In An Estate Plan

Fixing The Imploding Irrevocable Life Insurance Trust Wealth

Fixing The Imploding Irrevocable Life Insurance Trust Wealth

Status Escape From The Real Colva Insurance Colvaservices

Status Escape From The Real Colva Insurance Colvaservices

Irrevocable Life Insurance Trust Attorney Plano Tx Law Offices

Irrevocable Life Insurance Trust Attorney Plano Tx Law Offices

Amazon Com The Best Policy Managing Irrevocable Life Insurance

Amazon Com The Best Policy Managing Irrevocable Life Insurance

Advantages Of An Irrevocable Life Insurance Trust Ilit Stein

Advantages Of An Irrevocable Life Insurance Trust Ilit Stein

Irrevocable Life Insurance Trust Absolute Trust Counsel

Irrevocable Life Insurance Trust Absolute Trust Counsel

Using Life Insurance In Charitable Planning

Using Life Insurance In Charitable Planning

Private Split Dollar Bowen Miclette Britt Insurance Agency Llc

Private Split Dollar Bowen Miclette Britt Insurance Agency Llc

Irrevocable Life Insurance Trust Special Needs Planning Center

Irrevocable Life Insurance Trust Special Needs Planning Center

Are You Confused What S An Irrevocable Life Insurance Trust

Are You Confused What S An Irrevocable Life Insurance Trust

Understanding Irrevocable Life Insurance Trusts Pdf Free Download

Understanding Irrevocable Life Insurance Trusts Pdf Free Download

Cascadia Wealth Management Mc Dowell Estate Planning Basics Jun

Cascadia Wealth Management Mc Dowell Estate Planning Basics Jun

7 Reasons To Buy Life Insurance In An Irrevocable Trust

7 Reasons To Buy Life Insurance In An Irrevocable Trust

Irrevocable Life Insurance Basics Trust Momentum Transamerica

Irrevocable Life Insurance Basics Trust Momentum Transamerica

0 Komentar untuk "Irrevocable Life Insurance"