It describes coverage that is in place for life. The following sample whole life insurance quotes are based on a preferred plus male wanting ordinary whole life insurance to age 100 with an a rated insurance company or better.

Whole Life Insurance Definition

Whole Life Insurance Definition

Policies with a death benefit up to 100000 are even available without a medical exam as long as you are working at least 30 hours per.

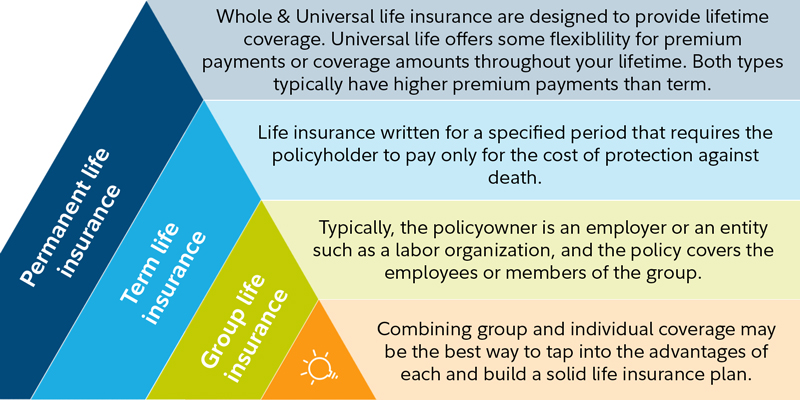

Individual whole life insurance. Monthly rates are for informational purposes only and must be qualified for. Whole life insurance or whole of life assurance in the commonwealth of nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insureds entire lifetime provided required premiums are paid or to the maturity date. Some whole life policies can be paid up after a certain number of years.

With whole life insurance your premium payments remain the same over the life of the policy. Individual whole life insurance whole life insurance is permanent insurance that has a fixed cost for the duration of the policy holders life. Whole life insurance covers you for a lifetime with steady premiums and a guaranteed return on the policys cash value.

Whole life insurance gives a policyholder lifetime coverage and a guaranteed amount to pass on to beneficiaries so long as the contract is up to date at the time or the policyholders death. Term life insurance policies can sometimes be more affordable for an individual than a whole life insurance policy. Ask your employer about aflac whole and term life insurance.

Also referred to as individual full life insurance. How do you know if whole life insurance is worth it. These products available through worksite payroll deduction only.

All cigna products and services are provided exclusively by or through operating subsidiaries of cigna corporation including loyal american life insurance company. Know where to buy whole life insurance and how to find the best policy. The cigna name logo and other cigna marks are owned by cigna intellectual property inc.

It also allows for cash value accumulation that can be used for emergencies college or even retirement expenses. You can choose how often youd like to make premium payments too annually semiannually quarterly or monthly. The individual whole life insurance policy is not available in fl or mt.

As long as your premiums are paid your beneficiary will receive the benefit amount upon your death. Individual whole life is a permanent type of life insurance. For juvenile life insurance ask your employer or contact aflac to apply now.

For some people and in some certain situations whole life insurance can be a worthwhile option. Whole life is the most common type of permanent life insurance.

Individual Single Premium Whole Life Insurance Policy Standards

Individual Single Premium Whole Life Insurance Policy Standards

Whole And Term Life Flex Complete Insurance Vantis Life

Whole And Term Life Flex Complete Insurance Vantis Life

Https Www Axisbank Com Docs Default Source Life Insurance Max Lifewhole Life Super Leaflet Pdf

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

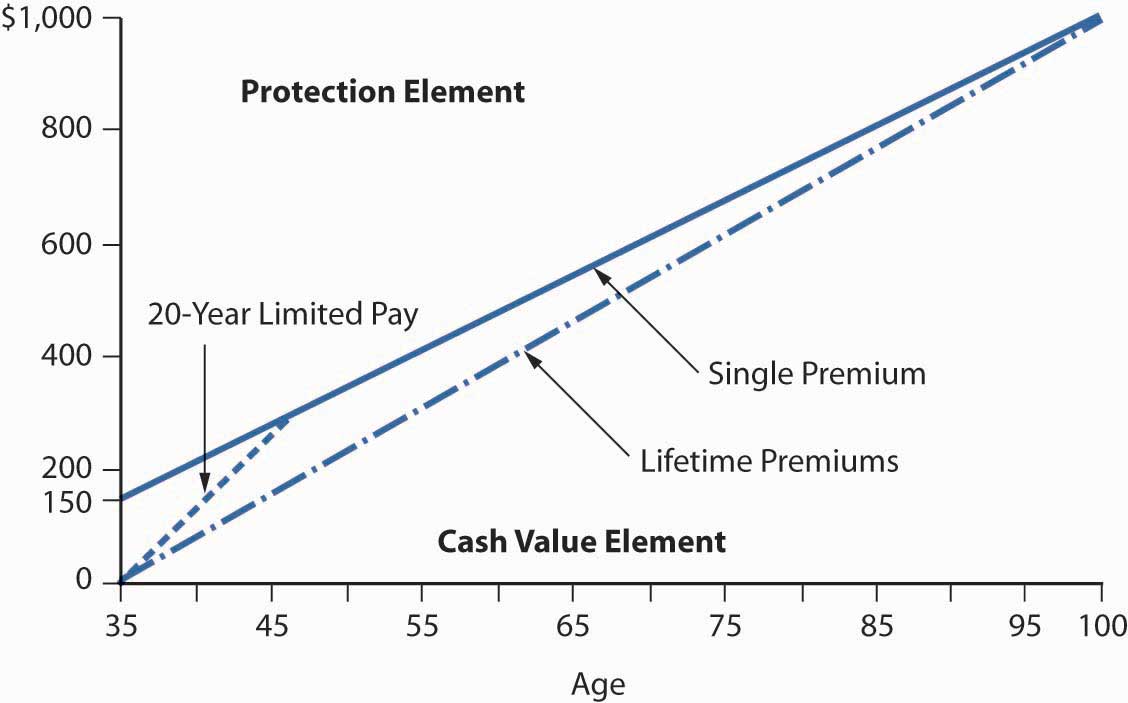

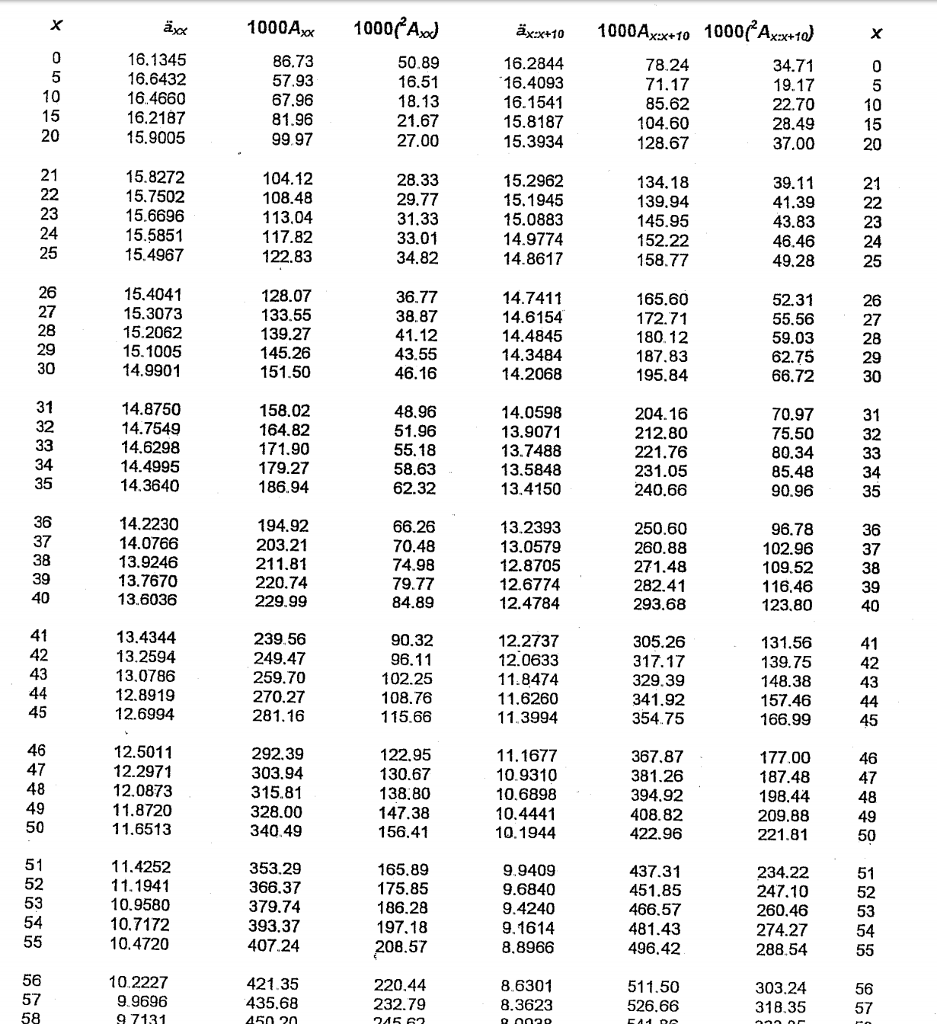

Mortality Risk Management Individual Life Insurance And Group

Mortality Risk Management Individual Life Insurance And Group

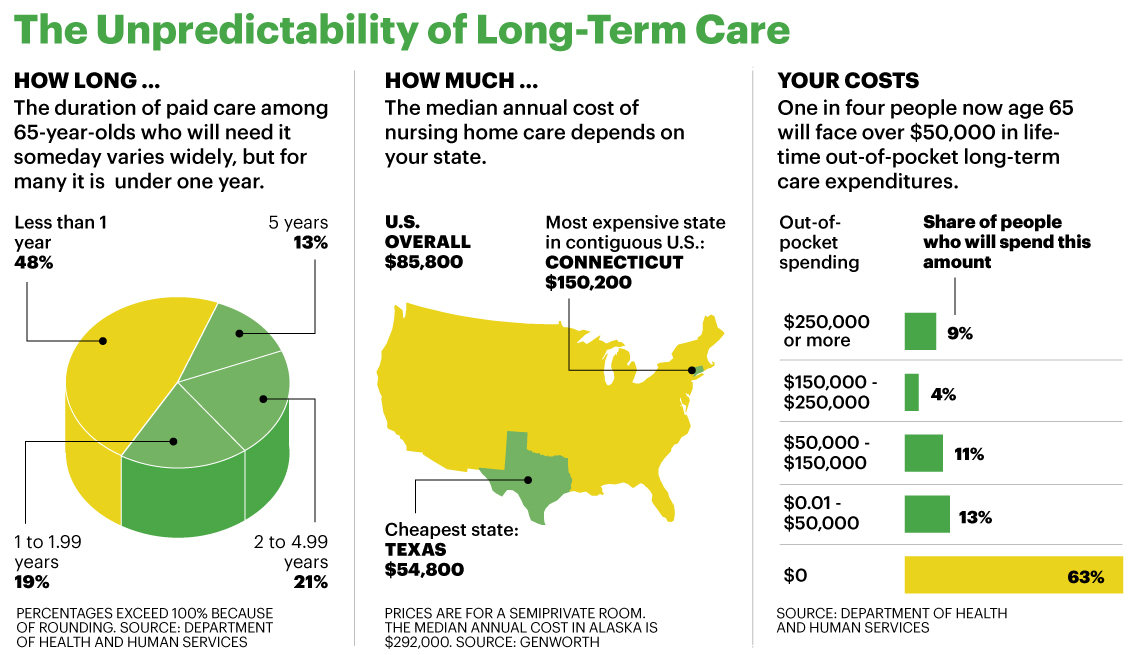

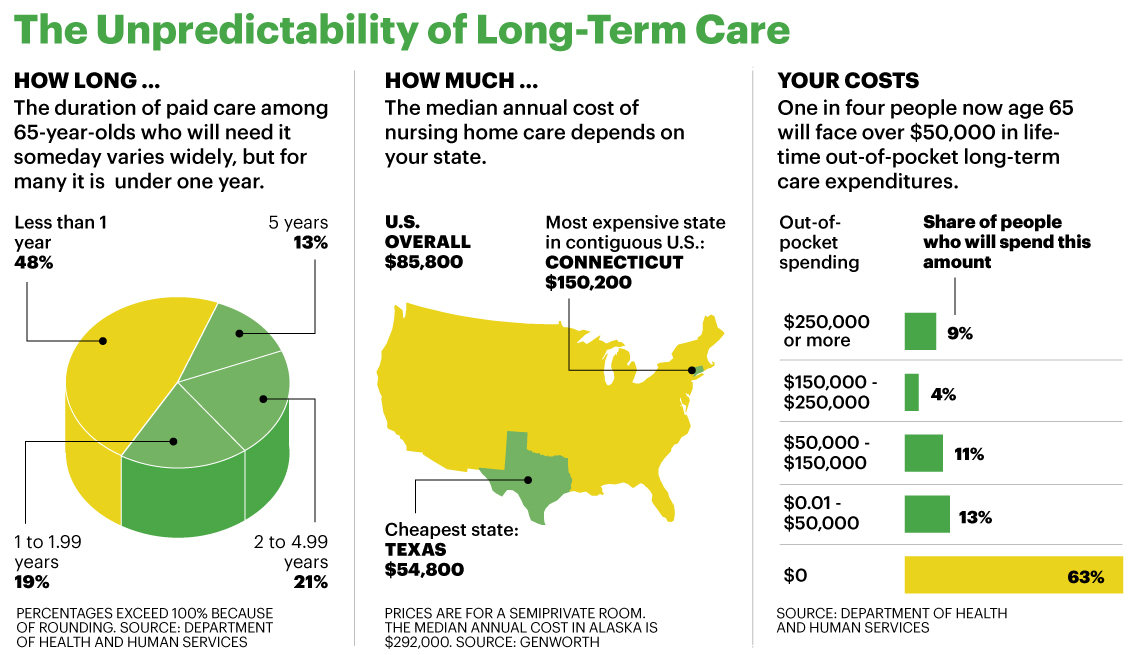

5 Facts You Should Know About Long Term Care Insurance

5 Facts You Should Know About Long Term Care Insurance

Whole Life Insurance Term Insurance Or Both What Your Financial

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

The Best Life Insurance Companies In 2020 Policygenius

The Best Life Insurance Companies In 2020 Policygenius

Life Insurance Insurance From Aig In The Us

Life Insurance Insurance From Aig In The Us

Whole Life Insurance Cash Value Chart

Life Insurance Online Life Insurance Plans Polices In India

Life Insurance Online Life Insurance Plans Polices In India

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

For A Fully Discrete Whole Life Insurance Of 100 Chegg Com

For A Fully Discrete Whole Life Insurance Of 100 Chegg Com

Whole Life Insurance Aig Direct

Layering Life Insurance Policies Fidelity Investments

Layering Life Insurance Policies Fidelity Investments

Term Life Insurance Definition

Term Life Insurance Definition

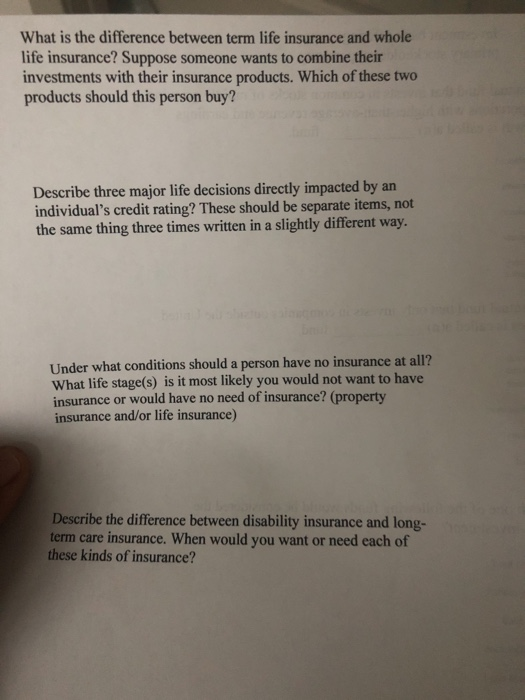

Solved What Is The Difference Between Term Life Insurance

Solved What Is The Difference Between Term Life Insurance

Prosperity Proof 4 Permanent Life Insurance Primer Truth Concepts

Prosperity Proof 4 Permanent Life Insurance Primer Truth Concepts

0 Komentar untuk "Individual Whole Life Insurance"