These deposits are held in a cash accumulation account within the policy. The most direct way to access the cash value in your policy is to make a withdrawal from it.

Insurance With Potential Cash Value Blog Consumers Credit Union

Insurance With Potential Cash Value Blog Consumers Credit Union

They can help you understand how doing so may affect your financial future.

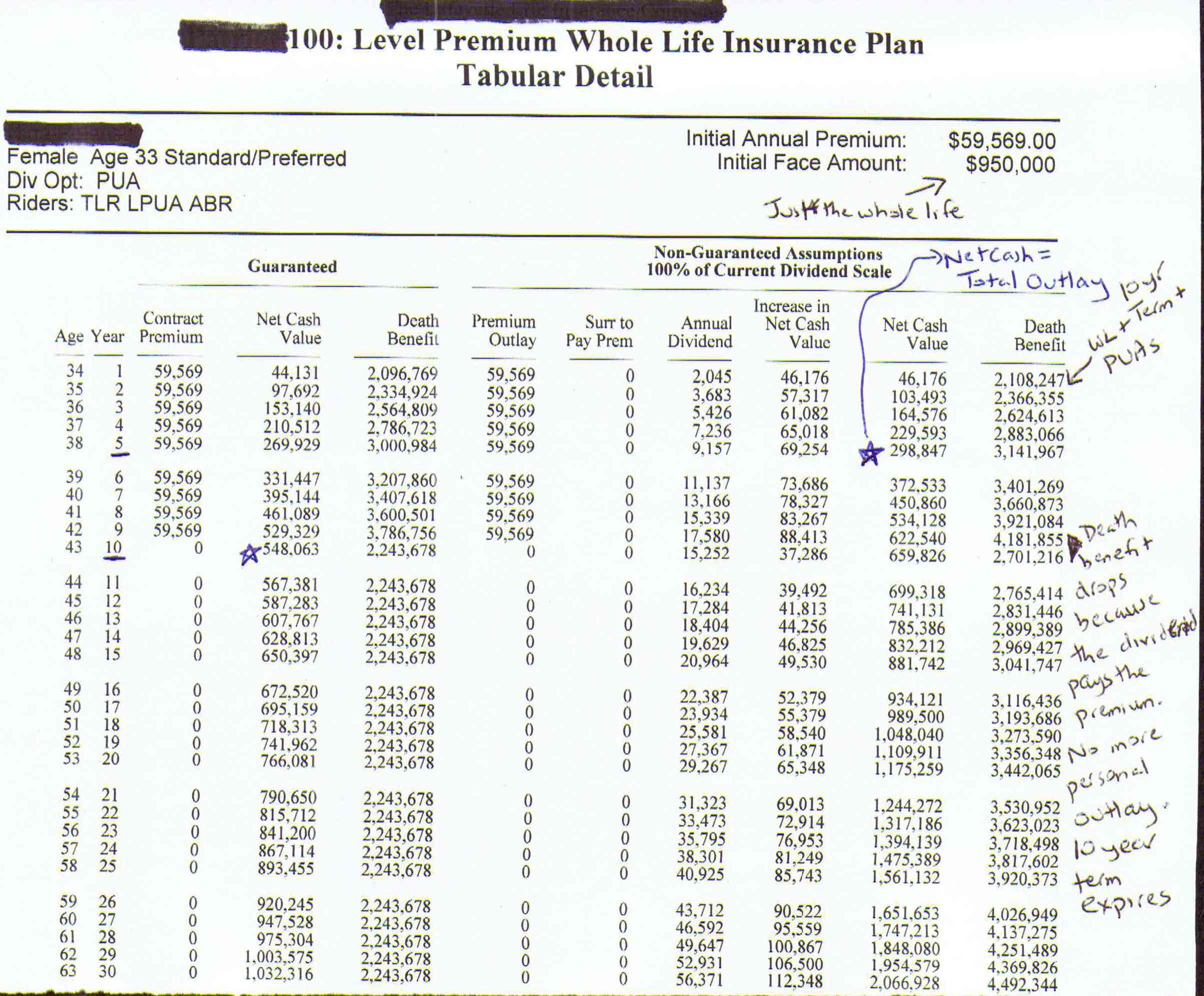

How to cash in life insurance. Whether to cash in a life insurance policy is an important decision. The choice can have a number of financial implications including tax liability. Cash value in a life insurance policy can really come in handy says matthew grove senior vice president of new york life.

Here are some factors to consider before. If you bought a whole life insurance policy when your kids were still in pull up pants youve probably built up a sizable stash of cash. And if youre heading into retirement with a decimated.

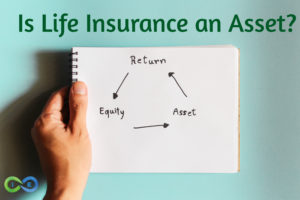

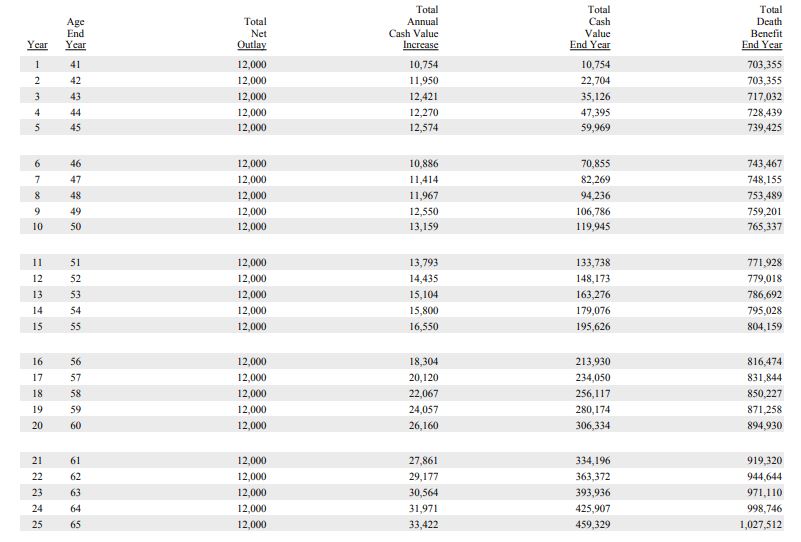

While income replacement is the primary purpose of life insurance many policyholders tap into cash value life insurance for other reasons such as building a nest egg for retirement. Among many other benefits permanent life insurance policies allow you to use the cash value for loans premium payments additional coverage and more. If you own one of these policies usually called permanent whole or universal life insurance you can cash it out in a relatively simple process.

If you want your whole life insurance policy will last until you die. How to cash out your life insurance policy. Our clients use cash value to pay for everything from household.

Walt disney ray kroc and james cash penney all famously cashed out life insurance policies to start their companies or to keep them afloat during tough times. Before you decide to sell your life insurance policy for cash if you need to get cash out of your life insurance policy seek the advice of a life settlement broker financial expert and a tax professional. Cash value life insurance such as whole life and universal life builds reserves through excess premiums plus earnings.

Cashing in your whole life insurance policy is a big decision that can have lasting consequences on your financial lifea whole life insurance policy grows cash value as you get older and as you pay your premiums. You can do this by notifying your life insurance carrier that you would like to take money out of your policy. However one of the most notable features is the option to sell or surrender your policy.

How Cash Value Life Insurance Works

How Cash Value Life Insurance Works

:max_bytes(150000):strip_icc()/life_insurance_87614098-5bfc37104cedfd0026c3e06a.jpg) When Life Insurance Isn T Worth It

When Life Insurance Isn T Worth It

Whole Life Insurance How It Works

Whole Life Insurance How It Works

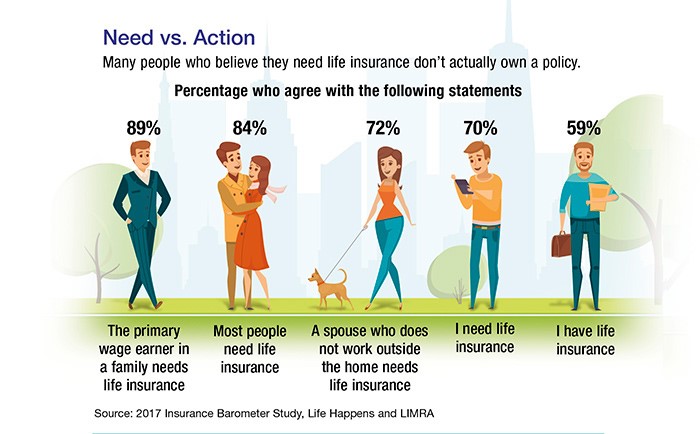

Is Life Insurance An Asset Why It May Be The Most Important Asset

Is Life Insurance An Asset Why It May Be The Most Important Asset

Cash Value In Life Insurance What Is It

Cash Value In Life Insurance What Is It

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Why Cash Value Life Insurance Is Bad And 4 Reasons It S Great

Why Cash Value Life Insurance Is Bad And 4 Reasons It S Great

Dividend Paying Whole Life Insurance The Alternative Fixed

Dividend Paying Whole Life Insurance The Alternative Fixed

Top 20 Best Whole Life Insurance Companies In 2020

Top 20 Best Whole Life Insurance Companies In 2020

Term Vs Cash Value Life Insurance Coastal Wealth Management

Term Vs Cash Value Life Insurance Coastal Wealth Management

What Is Cash Value In A Life Insurance Policy Auto Insurance Login

What Is Cash Value In A Life Insurance Policy Auto Insurance Login

High Cash Value Life Insurance Becoming Your Own Bank

High Cash Value Life Insurance Becoming Your Own Bank

Should You Use Life Insurance To Fund Your Retirement On

Should You Use Life Insurance To Fund Your Retirement On

Individual Life Insurance And Investment Pioneer Your Insurance

Individual Life Insurance And Investment Pioneer Your Insurance

Can I Withdraw Cash Value From Any Life Insurance Policy Globe

Can I Withdraw Cash Value From Any Life Insurance Policy Globe

Cash Value Life Insurance For Your Child Grow Up Plan Gerber

Cash Value Life Insurance For Your Child Grow Up Plan Gerber

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

Journal Bringing Real Clarity And Understanding Of Cash Value Life

Journal Bringing Real Clarity And Understanding Of Cash Value Life

0 Komentar untuk "How To Cash In Life Insurance"