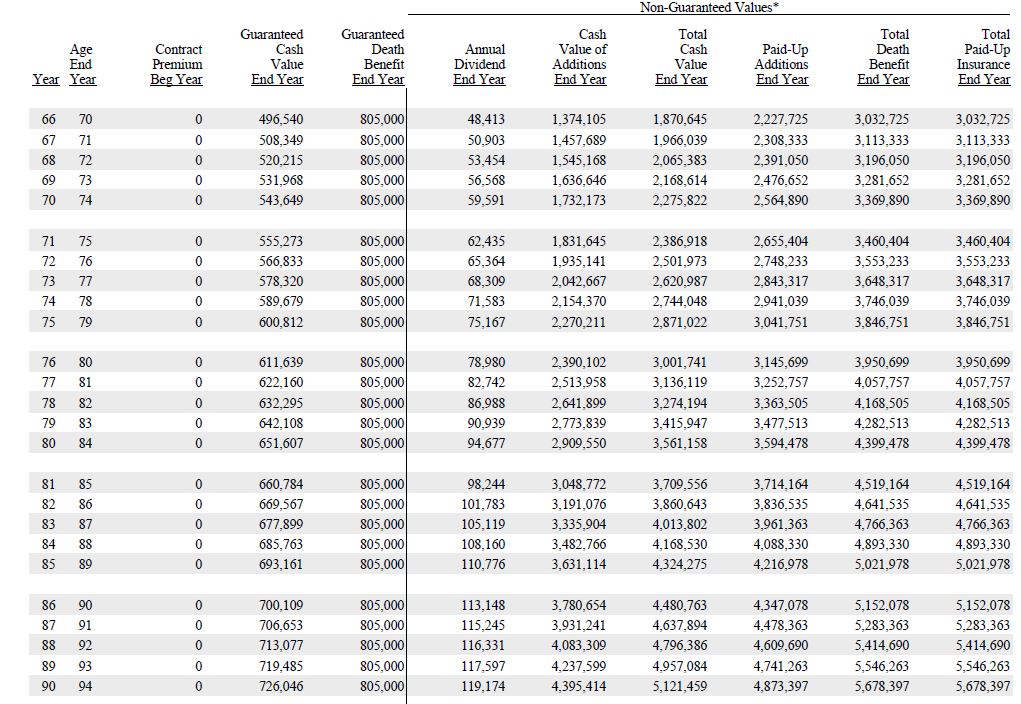

If you decide to cancel the policy after 20 years then you could get back over 88000 however you would lose over 300000 of death benefit. How to cancel life insurance.

Whole Life Insurance Definition

Whole Life Insurance Definition

Before you cancel your life insurance policy its worth considering your alternatives.

How to cancel a whole life insurance policy. When you call your insurance provider to cancel your whole life insurance policy youre officially surrendering the policy in insurance lingo. However its probably not the best choice in the log run. Yes you can cancel a whole life policy.

If you want to cancel your life insurance policy because your premiums are too high or because your health has changed there may be a way to change the terms of your policy without canceling depending on the type of policy you have. Cancel whole life insurance. Youll also need to be aware of any surrender fees that are associated with canceling the policy.

If the policy has a reserve value when the payments are discontinued you may elect to receive a cash value payment or receive paid up life insurance for a reduced face amount. There are many reasons why you many need to cancel life insurance for yourself or a loved one. Canceling your whole life is definitely and option.

You may no longer have the funds to pay for the policy. Life insurance tends to be cheaper the younger you are when you take out the policy. But unlike term insurance the cash value of whole insurance means you cant simply stop paying the premiums and assume the policy will end.

You may want to cash out the money that you have put into. To cancel a whole life insurance policy you should contact the agent or insurance company which sold it to you and find out what steps need to be taken. The coverage can last your entire life premiums are generally guaranteed and.

So if you are planning to cancel your policy temporarily only to reinstate it later on you might want to reconsider as this option often proves to be a false economy. If youve been covered for longer you have options that may allow you to take the cash value keep the death benefit or both. Whole life insurance can be a great way to set money aside for your later years.

Cancelling whole life insurance. However if you want to get out of the policy for whatever reason there are steps youll need to go through. If you cancel a whole life insurance policy when you havent had it for very long you face surrender fees and may not get any of your policys cash value.

Your whole life insurance policy may be an important source of financial security. Unlike term life if you just stop making payments this wont necessarily cancel a cash value life insurance policy.

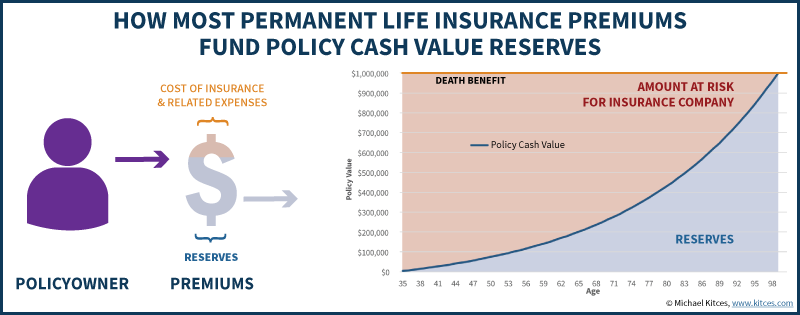

Understanding How A Whole Life Insurance Works

Understanding How A Whole Life Insurance Works

:brightness(10):contrast(5):no_upscale()/GettyImages-185263144-5707e5853df78c7d9ea4c954.jpg) Whole Life Insurance Explained

Whole Life Insurance Explained

Why You Shouldn T Cancel Your Whole Life Insurance

Why You Shouldn T Cancel Your Whole Life Insurance

When To Cash In A Life Insurance Policy The Dough Roller

When To Cash In A Life Insurance Policy The Dough Roller

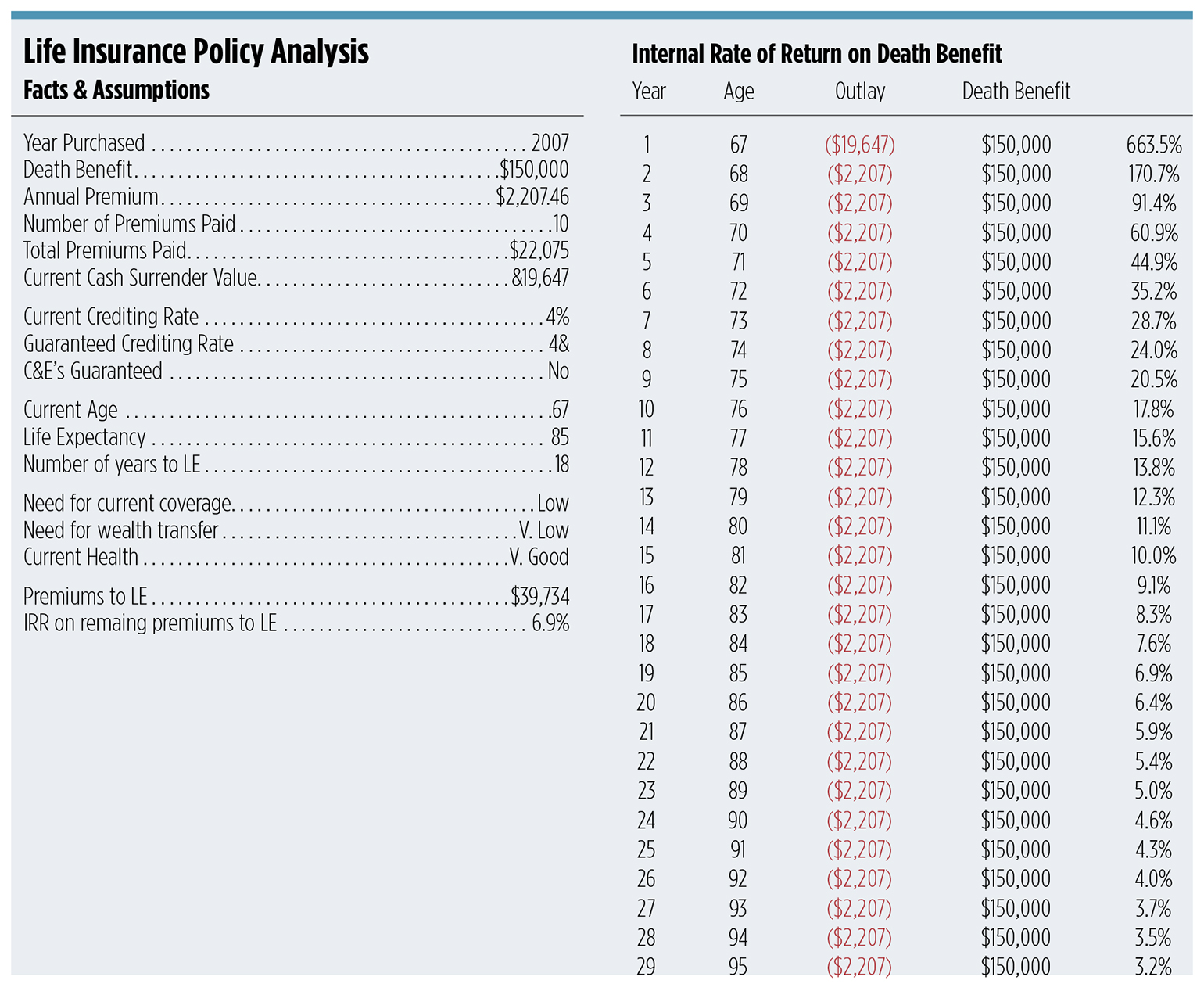

Surrender A Universal Life Insurance Policy Wealth Management

Surrender A Universal Life Insurance Policy Wealth Management

The Pros And Cons Of Whole Life Insurance

The Pros And Cons Of Whole Life Insurance

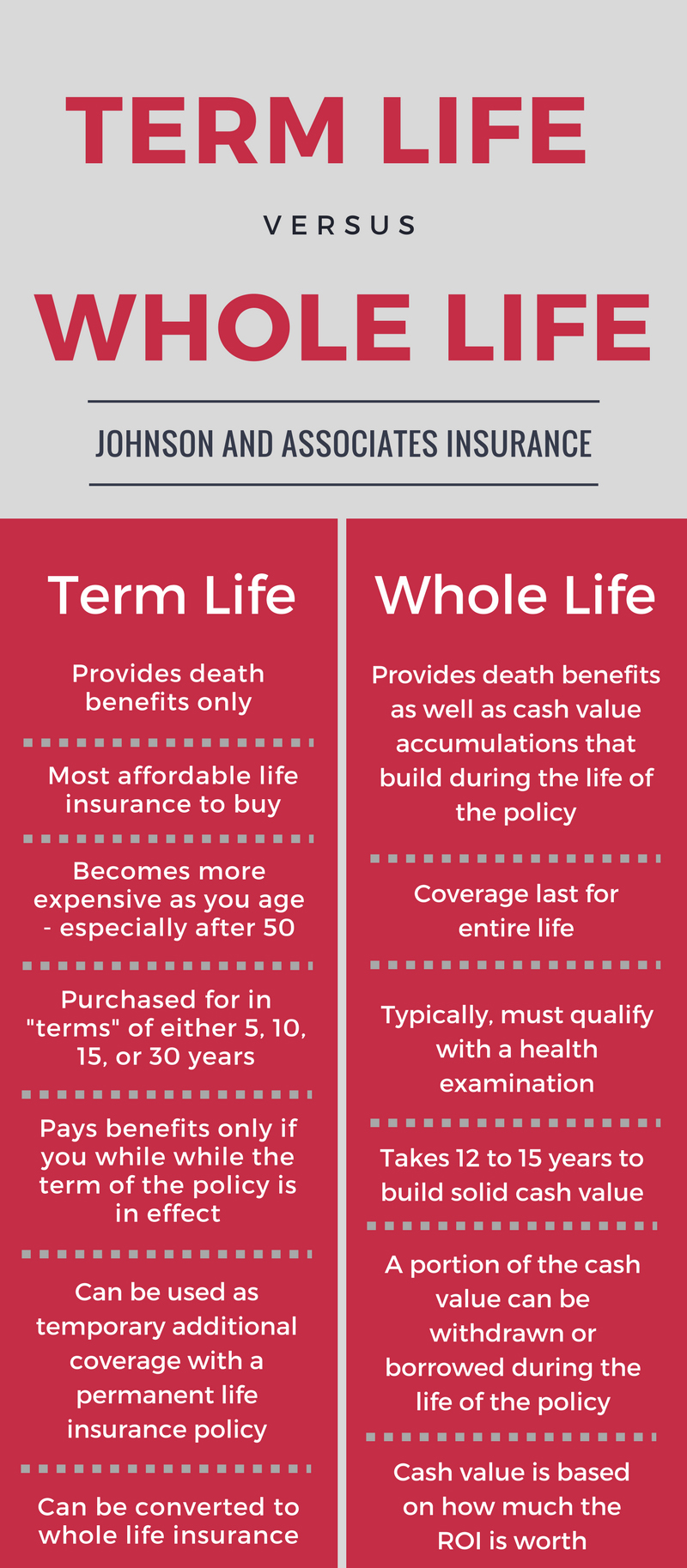

Term Life Insurance Vs Whole Life Insurance Johnson

Term Life Insurance Vs Whole Life Insurance Johnson

Difference Between Whole Life And Term Life Insurance Policy 2020

Difference Between Whole Life And Term Life Insurance Policy 2020

Life Insurance For Children The Best Policy For Your Kids

Life Insurance For Children The Best Policy For Your Kids

The Ultimate Guide To Life Insurance

The Ultimate Guide To Life Insurance

Why You Shouldn T Cancel Your Whole Life Insurance

Why You Shouldn T Cancel Your Whole Life Insurance

Advantages Of A Whole Life Insurance Policy Insurance

Advantages Of A Whole Life Insurance Policy Insurance

25 000 00 Whole Life Insurance United Of Omaha Life Insurance

25 000 00 Whole Life Insurance United Of Omaha Life Insurance

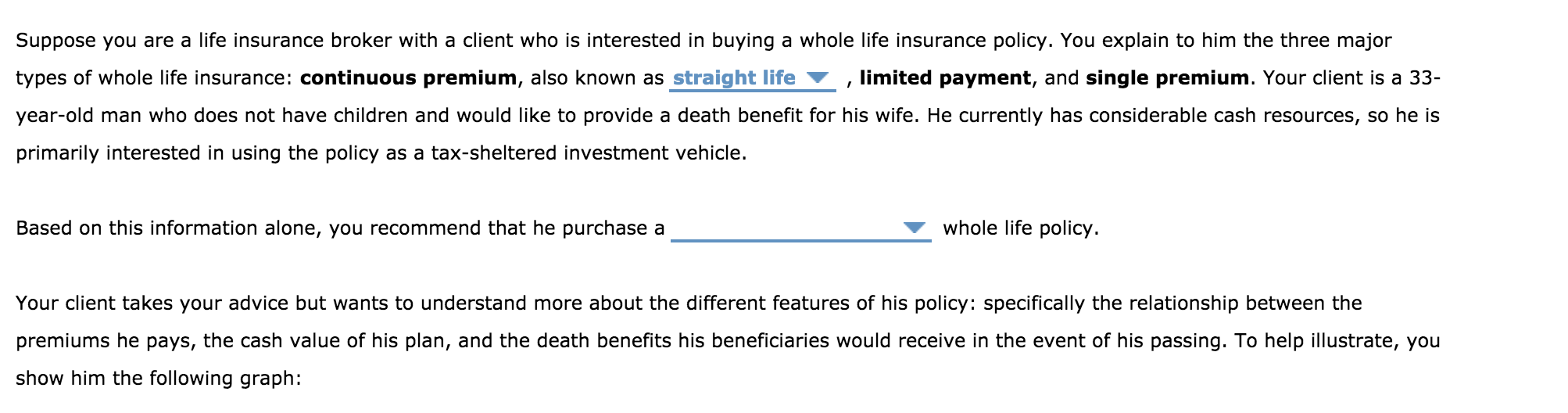

Suppose You Are A Life Insurance Broker With A Cli Chegg Com

Suppose You Are A Life Insurance Broker With A Cli Chegg Com

Is Whole Life Insurance Right For You What You Must Know

Is Whole Life Insurance Right For You What You Must Know

How To Cancel Your Life Insurance Policy Policygenius

How To Cancel Your Life Insurance Policy Policygenius

Explanation Of Term And Whole Life Insurance

Explanation Of Term And Whole Life Insurance

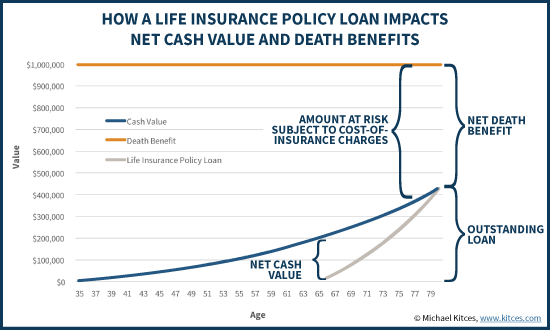

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

0 Komentar untuk "How To Cancel A Whole Life Insurance Policy"