Universal life insurance costs a lot more than other types of life insurance policies in terms of premiums paid and fees especially when you compare it to term life insurance. Life insurance is too expensive.

:max_bytes(150000):strip_icc()/GettyImages-1005014082-9bc5937167a54ad0b546762d6de89ace.jpg) Universal Life Insurance Definition

Universal Life Insurance Definition

What is universal life insurance and how does it work.

How much does universal life insurance cost. An independent life insurance broker representing several companies can help you find the right policy at the right price. If you purchase universal life insurance at a younger age your premiums will be cheaper. Average universal life insurance quotes.

Universal life insurance also commonly referred to as a ul policy is a form of life insurance that offers flexible premiums a level or increasing death benefit and a tax deferred investment opportunity to the insured. If you have a 100k policy and its paying 6300 a month the forst year as the year may come to maybe 25 years later depending on age when the policy first opened the benefit. Healthy 35 year old man who pays 430 a year for a 500000 term policy would pay about 4400 a year for a 500000 universal life.

Some universal life policy have a cash value accumulation and an increased benefit so ex. Wondering how much universal life insurance will cost you. Universal life is usually 3 to 4 times the cost of term.

If you have further question or feel tat i could be of assistance please do not hesitate to contact me. How much will life insurance cost me. The cost of universal life insurance for a 500000 policy can range widely from around 1683 to 10315 depending on your age when you buy the insurance.

Myths about life insurance. The cost of universal life insurance is the minimum amount of a premium payment required to keep the policy active. See average life insurance rates for 2020 for healthy nonsmoking men and women at different ages coverage amounts and policy lengths.

Life insurance is a simple concept. So how much does variable universal life cost. But it can be confusing and many people opt out of the safety net life insurance creates because they dont understand how it works as part of a financial plan.

Universal life insurance has all the benefits and riders of a whole life policy. Here are the top three myths about life insurance. Weve researched life insurance rates for a wide variety of profiles to help give you an idea of what you may be paying in premiums for a new policy.

Want to know how the average cost of life insurance changes based upon your policy age and health. Pay now to protect your family later. A universal life insurance policy can accumulate cash value which earns.

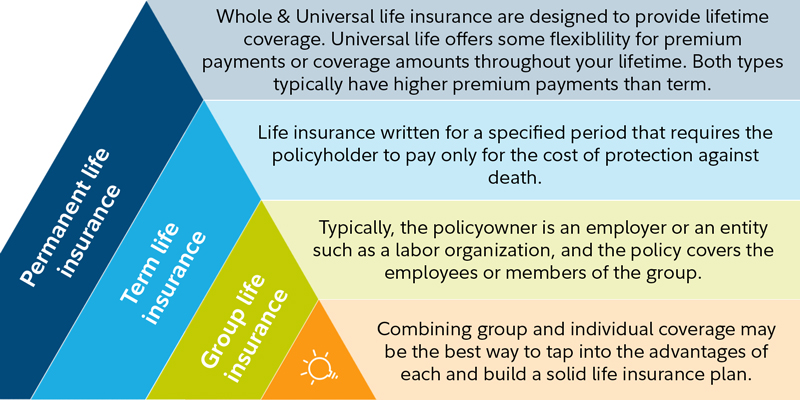

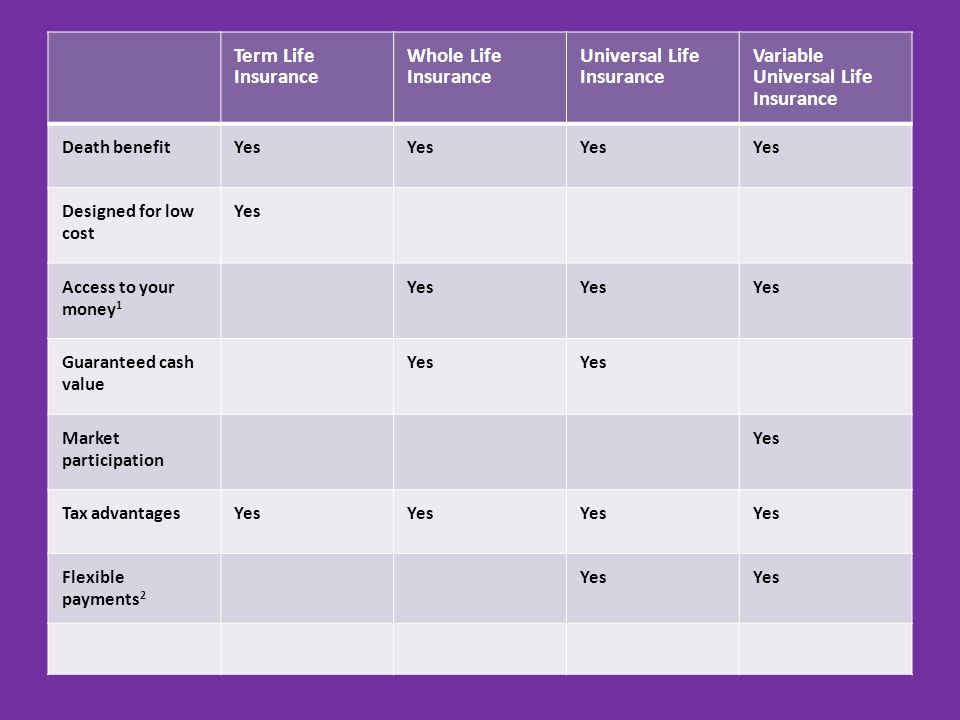

Difference Between Term Universal And Whole Life Insurance

Difference Between Term Universal And Whole Life Insurance

Layering Life Insurance Policies Fidelity Investments

Layering Life Insurance Policies Fidelity Investments

Indexed Universal Life Iul Insurance Policies All You Need To

Indexed Universal Life Iul Insurance Policies All You Need To

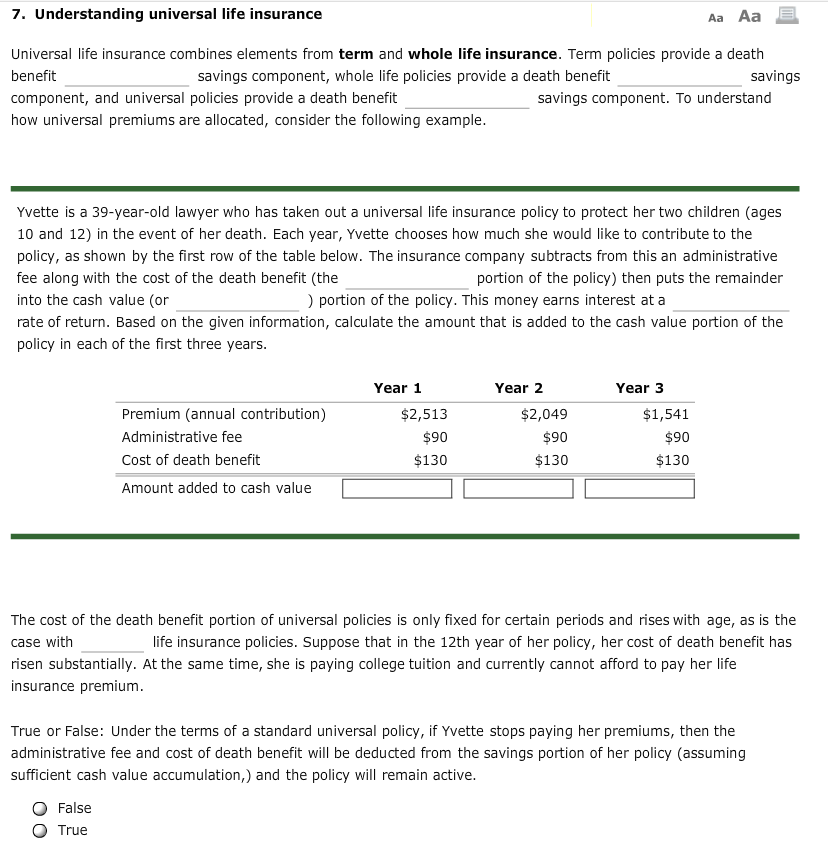

Universal Life Insurance Combines Elements From Te Chegg Com

Universal Life Insurance Combines Elements From Te Chegg Com

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Options For Blank 1 And No Bundled With A And A Chegg Com

Options For Blank 1 And No Bundled With A And A Chegg Com

Term Life Vs Whole Life Insurance Whole Life Insurance Term

Term Life Vs Whole Life Insurance Whole Life Insurance Term

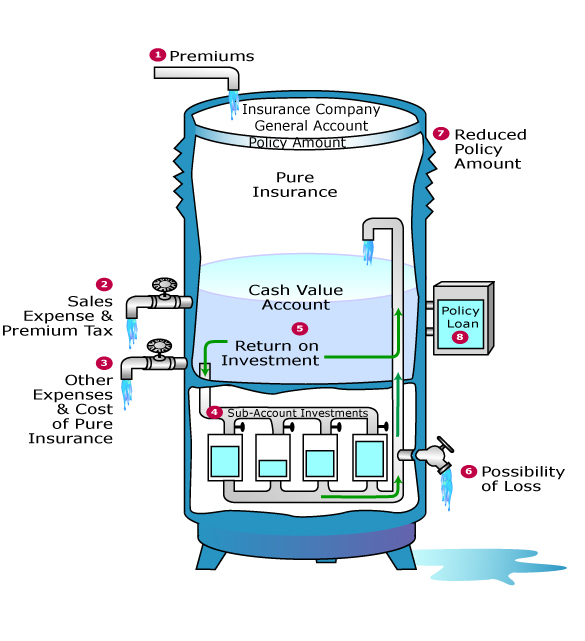

Variable Universal Life Insurance Vul Success Financial Freedom

Variable Universal Life Insurance Vul Success Financial Freedom

Types Of Life Insurance Chart Parta Innovations2019 Org

Types Of Life Insurance Chart Parta Innovations2019 Org

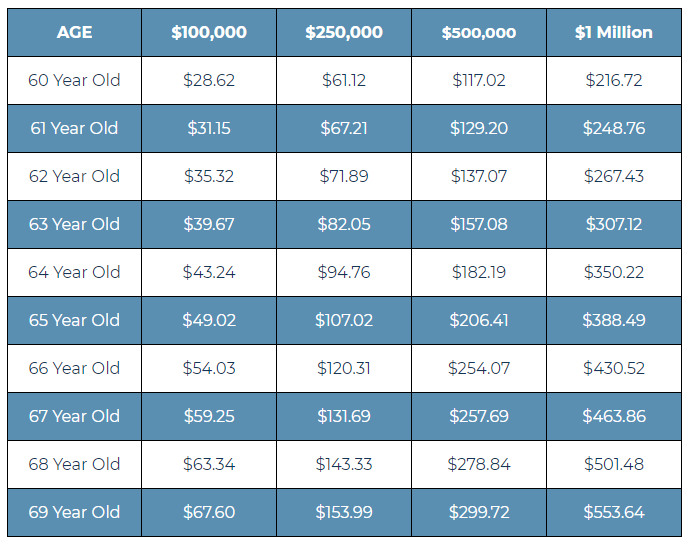

Instant Term Life Insurance Quote After Retirement Ages 65 79

Instant Term Life Insurance Quote After Retirement Ages 65 79

What Is Cash Value Life Insurance Daveramsey Com

What Is Cash Value Life Insurance Daveramsey Com

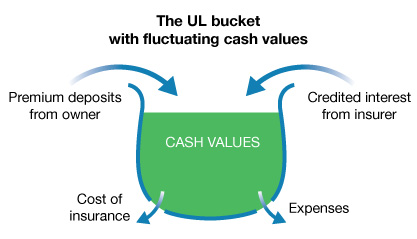

Division Of Financial Regulation Universal Life Premium Life

Division Of Financial Regulation Universal Life Premium Life

+Insurance.+VUL+is+a+sub-optimal+investment+which+benefits+the+provider+more+than+the+customer.+Buy+term+life+insurance+and+invest+the+difference.png) Personal Finance Apprentice Why I Don T Like Variable Universal

Personal Finance Apprentice Why I Don T Like Variable Universal

Military Life Insurance Trans World Assurance

Military Life Insurance Trans World Assurance

What Is Universal Life Insurance

What Is Universal Life Insurance

Variable Universal Life Insurance 4j Wealth Management

Variable Universal Life Insurance 4j Wealth Management

Comparison Between Various Insurance Policies Ppt Download

Comparison Between Various Insurance Policies Ppt Download

Term Life Insurance For 60 69 Year Olds Best Rates For 2020

Term Life Insurance For 60 69 Year Olds Best Rates For 2020

/lifeinsurance_92028809-4b6132cdc97d48cf935221ca533011bc.jpg) Universal Life Insurance Definition

Universal Life Insurance Definition

What Kind Of Life Insurance Is Cheaper I M Not Sure About Term Vs

What Kind Of Life Insurance Is Cheaper I M Not Sure About Term Vs

What Is Vul Insurance And Should You Get One Moneymax Ph

What Is Vul Insurance And Should You Get One Moneymax Ph

Universal Life Insurance Provident Investment Services

Universal Life Insurance Provident Investment Services

Guaranteed Universal Life Insurance Quotes What Does It Cost

Guaranteed Universal Life Insurance Quotes What Does It Cost

0 Komentar untuk "How Much Does Universal Life Insurance Cost"