Life insurance is a major component of estate planning. As a financial advisor he specializes in working with many local business owners in new york and boca raton fl.

Wealth Elite Building Your Legacy Pdf Free Download

Wealth Elite Building Your Legacy Pdf Free Download

Jason is the founder and president of client focused advisors.

High net worth life insurance. After all when you have a certain amount of money you might consider yourself essentially self insured. High net worth life insurance if you are looking for low cost comprehensive insurance then we can provide you with multiple quotes to help you find a provider you are happy with. High net worth life insurance if you are looking for an easy way to get insurance quotes then our service provides you with a convenient way to get the information you need.

High net worth life insurance a guide for wealthy individuals cfa insurance posted in financial planning last updated on october 21 2019. Its a necessity for high net worth individuals that wish to preserve their estate for future generations. By properly developing an es.

Welcome to high net worth life. Life insurance is absolutely vital for individuals with high net worth. Whether you want to protect your legacy supplement your retirement income or create an executive compensation strategy cash value life insurance can help.

Learn more about which companies high net worth individuals should turn to for coverage and permanent life insurance. Life insurance can be valuable for people with a high net worth because its offered tax free and can protect against the estate tax. Its probably not unusual for people with high net worth to assume they dont need life insurance.

A good high net worth insurance agent diligently notes all hard to replace possessions finds a way to appraise them accurately and offers an insurance solution that covers against the right risks. Approximately 124 million people worldwide fit this description. 4 selling life insurance successfully to the hnwi market the high net worth market the global high net worth hnw market currently consists of individuals with at least us1 million of investable assets exclusive of their primary residences.

Not only is a great way to protect your beneficiaries in the future but life insurance also offers opportunities for some amazing tax advantages if you have a lot of assets.

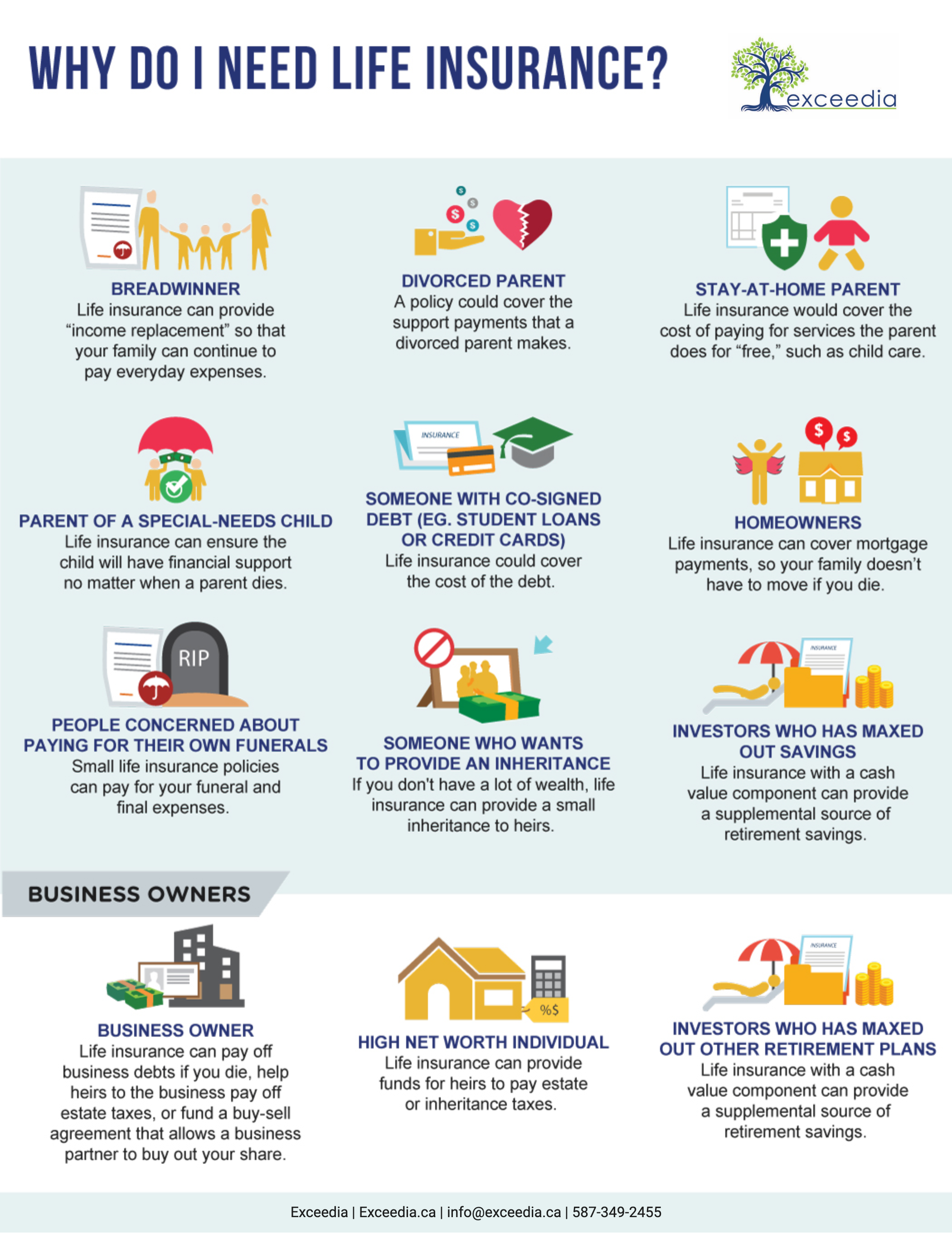

Do You Really Need Life Insurance Exceedia

Do You Really Need Life Insurance Exceedia

Html Email Newsletter For Insurance Consultants On Behance

Html Email Newsletter For Insurance Consultants On Behance

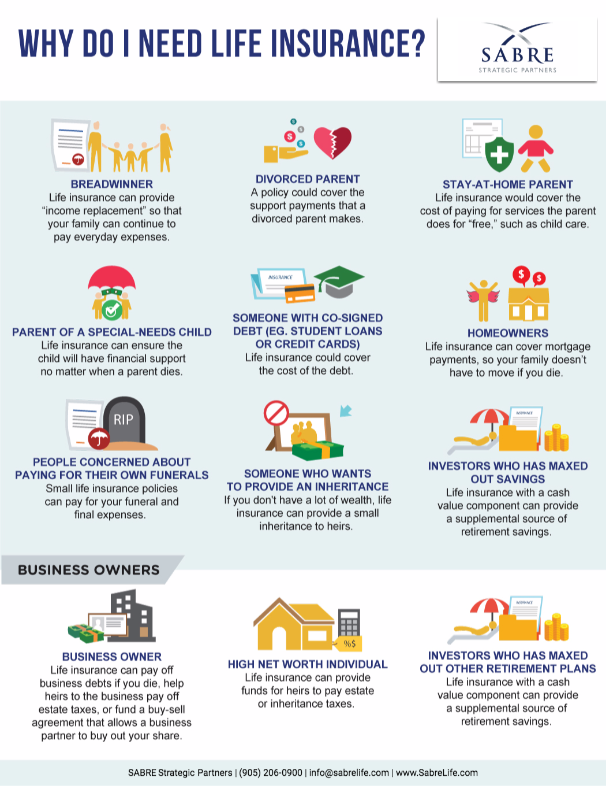

Do You Really Need Life Insurance Sabre Strategic Partners

Do You Really Need Life Insurance Sabre Strategic Partners

Why High Net Worth Clients Should Be More At Home With Life Insurance

Why High Net Worth Clients Should Be More At Home With Life Insurance

When Serving The Life Insurance Needs Of High Net Worth Clients

When Serving The Life Insurance Needs Of High Net Worth Clients

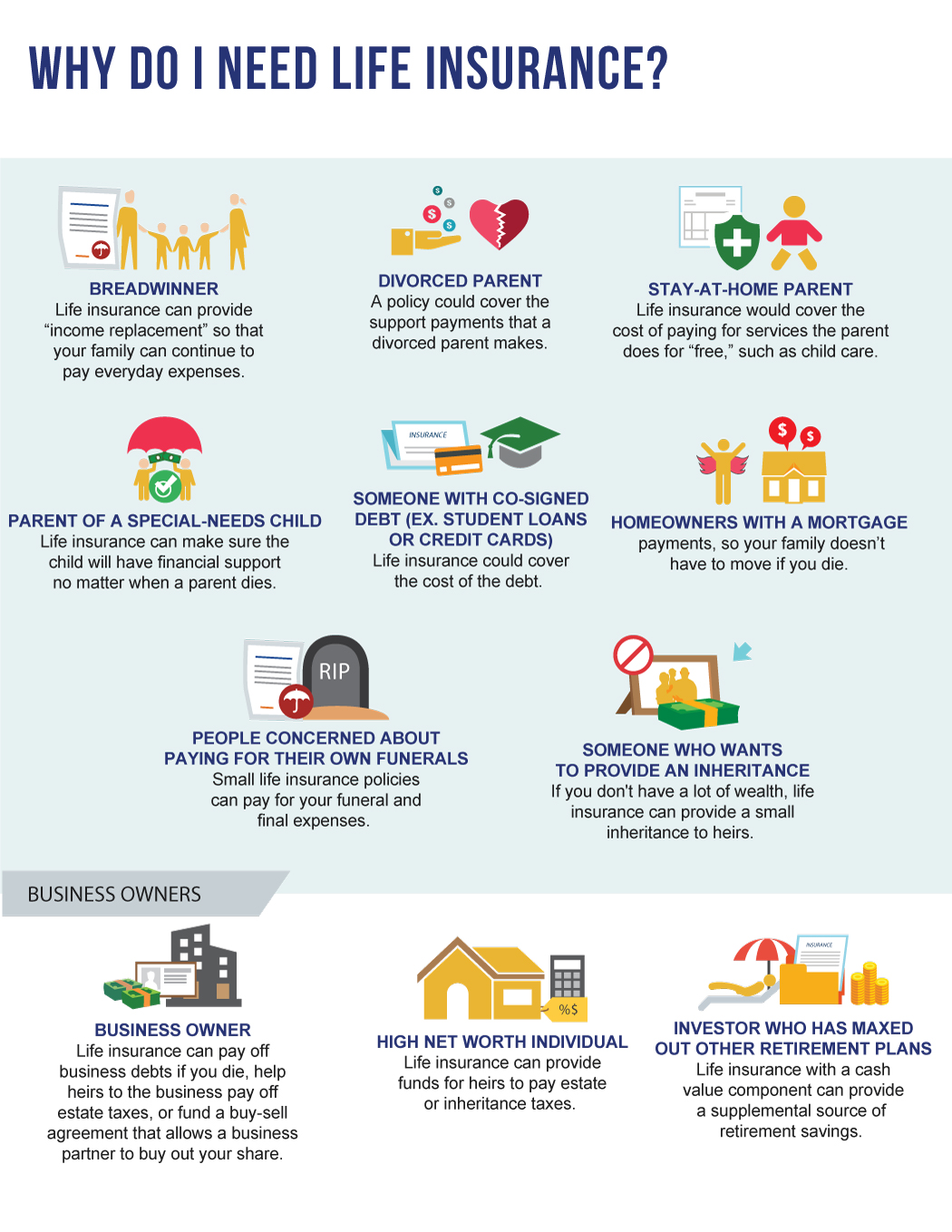

Do You Really Need Life Insurance Legacy Wealth Advisors

Do You Really Need Life Insurance Legacy Wealth Advisors

Life Insurance In A Changing Tax Environment M Financial

Life Insurance In A Changing Tax Environment M Financial

Proprietary Products Life Insurance Trc Financial

Proprietary Products Life Insurance Trc Financial

Wealthy People Or So They Are Called The High Net Worth

Wealthy People Or So They Are Called The High Net Worth

What Is Risk Management For High Net Worth Individuals

What Is Risk Management For High Net Worth Individuals

Tax Strategy Leverage And Life Insurance

Tax Strategy Leverage And Life Insurance

Life Insurance Used As Wealth Management Tool Invest News Top

Life Insurance Used As Wealth Management Tool Invest News Top

Jrc Insurance Group On Twitter Think High Net Worth Individuals

Jrc Insurance Group On Twitter Think High Net Worth Individuals

Life Insurance For Estate Planning Guide For High Net Worth

Life Insurance For Estate Planning Guide For High Net Worth

Premium Financing Plans Allmerits Financial

Premium Financing Plans Allmerits Financial

Life Insurance Jupiter Island Insurance

Life Insurance Jupiter Island Insurance

Death Benefit Design Castle Re

Death Benefit Design Castle Re

The Life Podcast For Financial Professionals Pacific Life

The Life Podcast For Financial Professionals Pacific Life

Solutions That Leave An Impression In The Wholesale Brokerage

Solutions That Leave An Impression In The Wholesale Brokerage

High Net Worth 7 Methods For Integrating Life Insurance Into Your

High Net Worth 7 Methods For Integrating Life Insurance Into Your

Lombard Launches High Net Worth Life Plan Assets Management

Lombard Launches High Net Worth Life Plan Assets Management

Medium High Net Worth Individuals Voice Their Insurance Preferences

Medium High Net Worth Individuals Voice Their Insurance Preferences

0 Komentar untuk "High Net Worth Life Insurance"