Unlike term life insurance permanent life insurance has no set term or expiration date. Combines life insurance protection with tax advantaged investment options enabling employees to grow their savings.

The Best Group Life Insurance Quotes Thenestofbooksreview

The Best Group Life Insurance Quotes Thenestofbooksreview

Permanent life insurance is actually a generic term for different types of life insurance policies that have no expiration date unlike term life insurance that is pegged to a fixed period.

Group permanent life insurance. The insurance costs will be paid by contributions of both the employer and the employee and the amount will depend on the preferred benefits. Unlike a term life policy a permanent life policy builds cash value over time as long as you continue to make premium payments. Permanent life insurance refers to coverage that never expires unlike term life insurance and combines a death benefit with a savings component.

Group permanent life insurance. A form of group life insurance wherein the policyholders are offered one of many plans of permanent life insurance. As with all our top life insurance companies lists it is a fluid one subject to change at our whim based on the different product offerings available in the marketplace.

Under a group permanent life insurance plan the participants have a vested interest in the increments of paid up insurance purchased. Group life insurance policies are generally written as term insurance offered as a group benefit to employees who meet eligibility requirements such as being a permanent employee or 30 days after. Group permanent life insurance a group life insurance plan where participants may choose permanent life insurance coverage in addition to or instead of term life insurance.

Group universal life gul. Are universal whole life and permanent life insurance plans the same. Portable permanent life insurance protection that builds cash value and helps employees prepare for whatever life brings6.

A spotlight on permanent life insurance. Group variable universal life gvul. Life insurance is almost always discussed in terms of the permanent form of coverage.

This options ensures that you have lifelong protection or at least as long as you continue to pay the required amount to maintain your coverage. The cost of the premiums for a permanent life insurance policy is more expensive than term life premiums. Group permanent life insurance is an permanent life insurance policy that is offered by an employer as a benefit to their employees.

The focus of the following article is on getting you familiar with our current crop of the top permanent life insurance companies.

Life Insurance Faqs Long Beach Ca

Life Insurance Faqs Long Beach Ca

Individual Life Insurance Principal

Individual Life Insurance Principal

Top 10 Pros And Cons Of Variable Universal Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

Liberty Financial Group Term Life Insurance Or Permanent Life

Liberty Financial Group Term Life Insurance Or Permanent Life

![]() Corporate Life Product Category Etiqa Life And General Assurance

Corporate Life Product Category Etiqa Life And General Assurance

Group Whole Life Insurance The Third Pillar Rpag News

Group Whole Life Insurance The Third Pillar Rpag News

Difference Between Cash Value And Face Value In Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

Permanent Life Insurance Definition

Permanent Life Insurance Definition

Colonial Penn Life Insurance Review 2020 Rates Fine Print

Colonial Penn Life Insurance Review 2020 Rates Fine Print

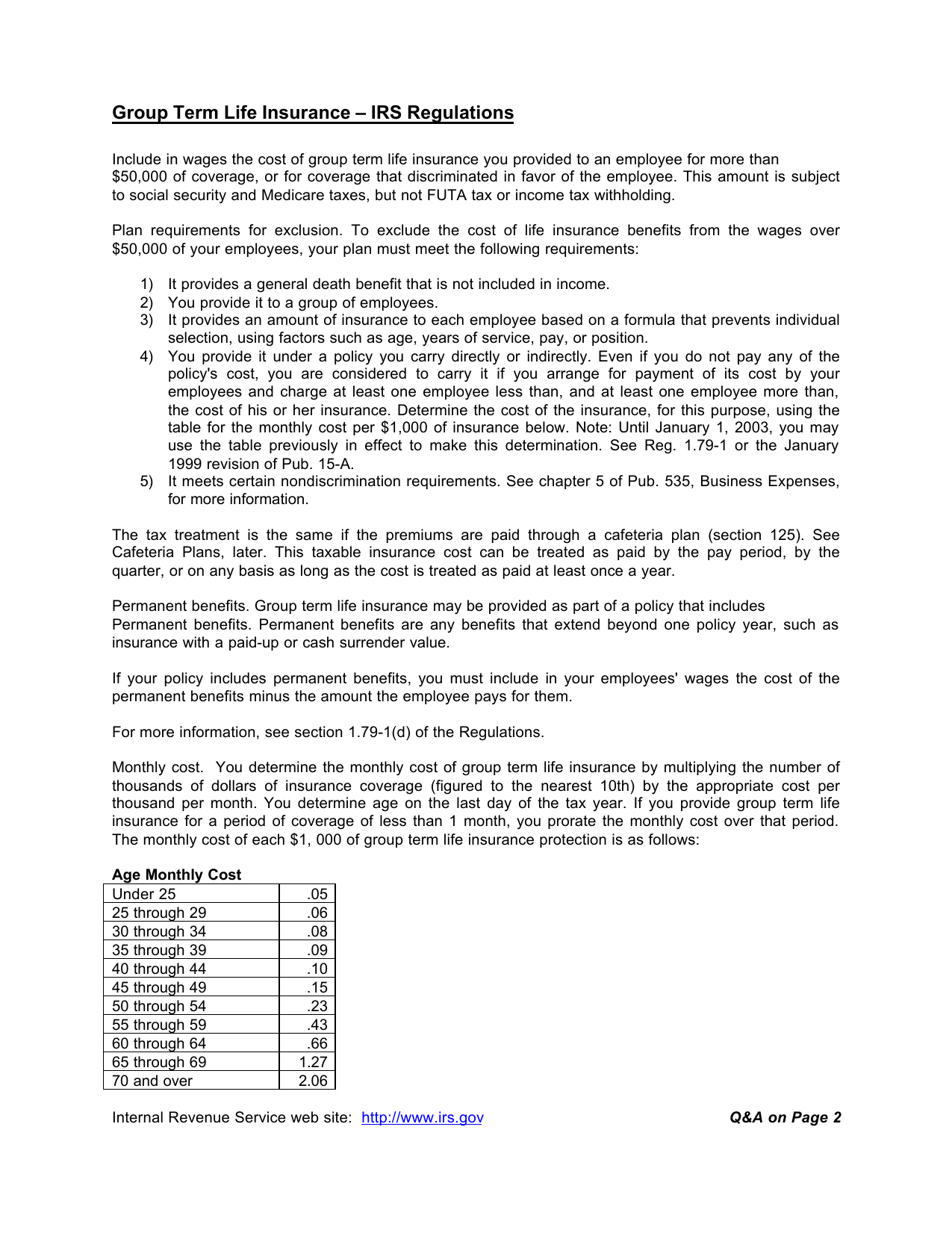

Group Term Life Insurance Irs Regulations

Group Term Life Insurance Irs Regulations

Three Things To Know About Permanent Life Insurance Meyers

Three Things To Know About Permanent Life Insurance Meyers

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

Split Dollar Loans With Permanent Life Insurance Ppt Download

Split Dollar Loans With Permanent Life Insurance Ppt Download

Permanent Life Insurance Feller Financial Youtube

Permanent Life Insurance Feller Financial Youtube

Guide To How Does Group Term Life Work Life Insurance Canada

Guide To How Does Group Term Life Work Life Insurance Canada

Permanent Life Insurance Velapoint

Permanent Life Insurance Velapoint

What Are The Principal Types Of Life Insurance Iii

What Are The Principal Types Of Life Insurance Iii

Indexed Universal Life Insurance Wealth Strategies Financial Group

Indexed Universal Life Insurance Wealth Strategies Financial Group

Best Insurance Homeownersinsurancefortlauderdale Best Insurance

Best Insurance Homeownersinsurancefortlauderdale Best Insurance

0 Komentar untuk "Group Permanent Life Insurance"